1.) The $600B Shift

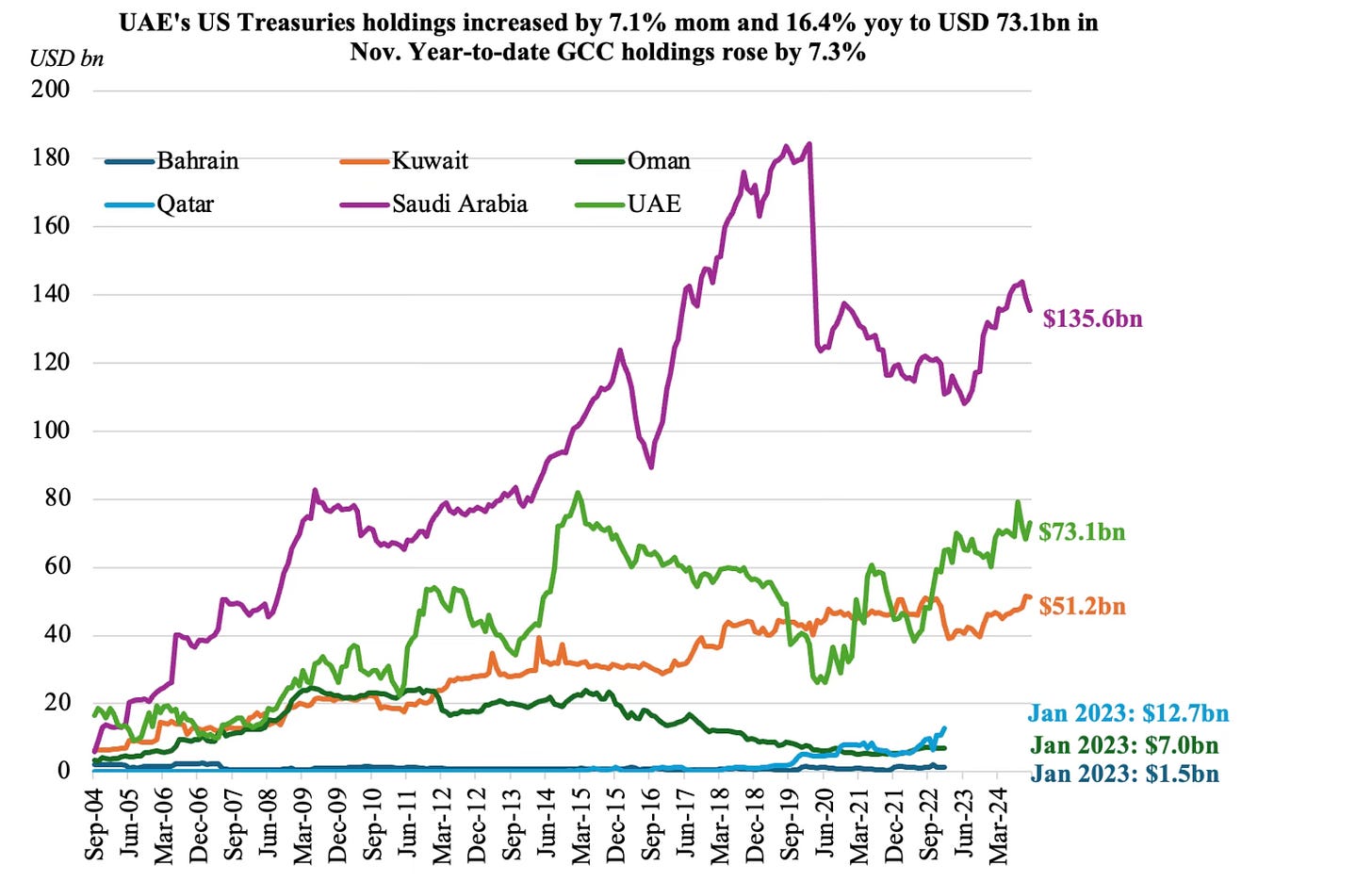

Trump’s $600B Saudi Deal Isn’t Just Historic—It’s a Blueprint for the Next Tech-Military-Data Order

A high-stakes meeting inside the Saudi Royal Court just redrew the map of global power. President Trump, flanked by the tech world’s most powerful names—Elon Musk, Sam Altman, Jensen Huang, Lisa Su, and Larry Fink—secured a $600 billion investment commitment from Saudi Arabia. This isn’t just oil diplomacy; it’s a full-stack geopolitical pivot into AI, defense, and digital infrastructure.

The Numbers That Matter:

$600B total U.S.–Saudi investment—the largest bilateral economic package in history

$142B in U.S. defense sales—America’s biggest arms deal to date

$80B+ in tech and AI—joint investment into infrastructure, cloud, and immersive systems

$20B from DataVolt to build AI data centers and green energy facilities in the U.S.

$2B in smart city and megaproject contracts awarded to U.S. infrastructure giants like AECOM and Parsons

AI diplomacy: Sam Altman, Elon Musk, and Palantir’s Alex Karp personally aligned with Crown Prince MBS on digital sovereignty and compute infrastructure

Why It’s Different:

Saudi Arabia is no longer content with just buying American assets—it wants equity in America’s future. These deals weave Saudi capital directly into the U.S. tech supply chain, from NVIDIA’s chips to OpenAI’s compute layer, accelerating America’s infrastructure ambitions while deepening Riyadh’s strategic foothold in the next era of defense and digital power.

The Big Picture:

AI is the new oil—and data centers are the new refineries

Defense tech goes vertical—merging cybersecurity, satellites, and weapons systems

Cloud + compute = soft power—Saudi aims to co-own critical infrastructure, not just rent it

This deal isn’t about bilateral trade—it’s about building the operating system of geopolitics.

2.) Google in a Post AI World

Alphabet’s $2T empire may be worth far more in pieces. Analyst Gil Luria argues Google should pursue a “big bang breakup,” spinning off YouTube, Cloud, Waymo, and its AI chip unit to unlock $3.7 trillion in combined value. With its search dominance challenged by AI and DOJ pressure mounting, investors are frustrated by Google’s low 16x forward earnings multiple—well below peers.

By separating into focused entities—YouTube as a Netflix peer, Cloud like Snowflake, and TPUs rivaling NVIDIA—Alphabet could reprice its growth narrative and attract fresh capital. In an AI-native world, the real risk isn’t regulation—it’s staying bundled in a structure built for yesterday’s internet.

3.) VC Is Dead. Long Live the Operator-Fund.

Venture Capital Is Evolving—And It Looks More Like Private Equity Every Day

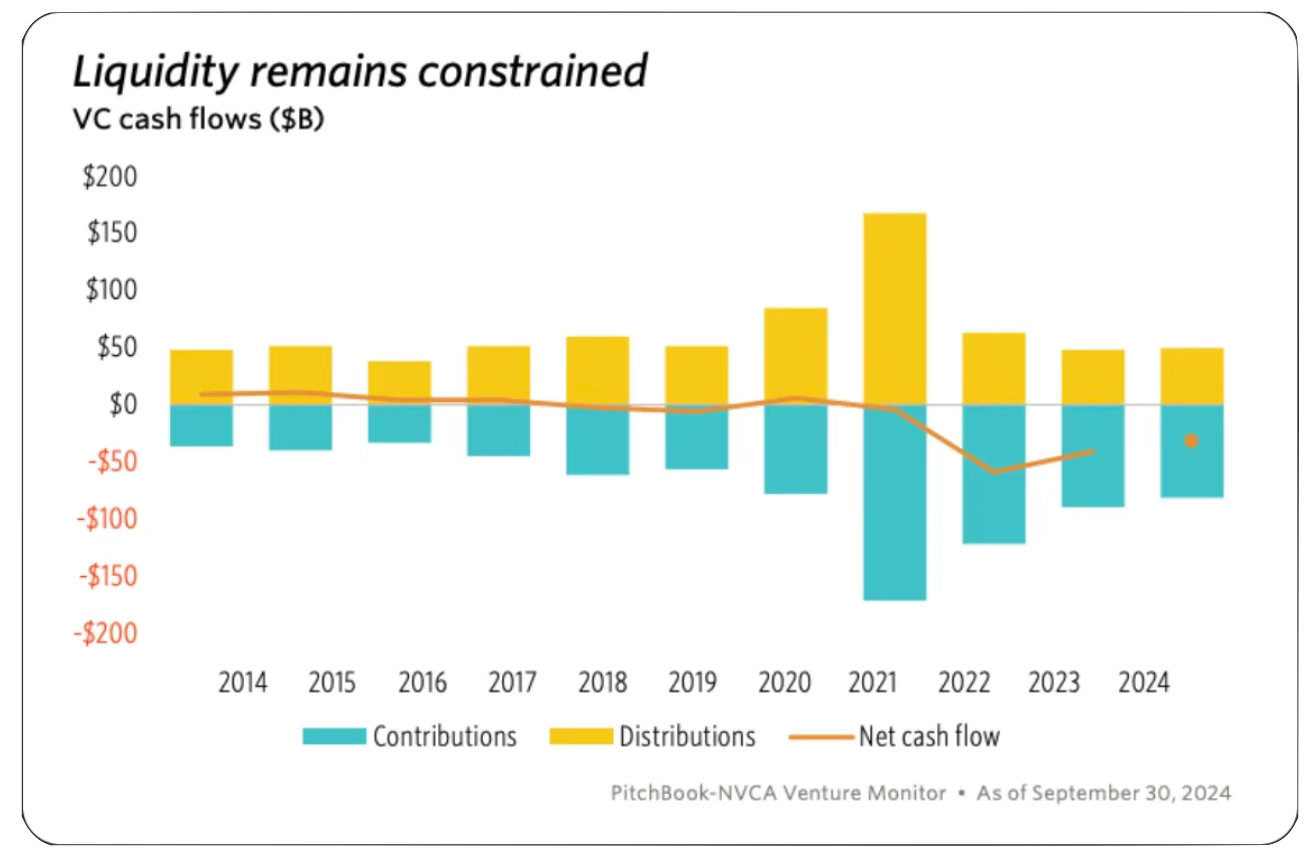

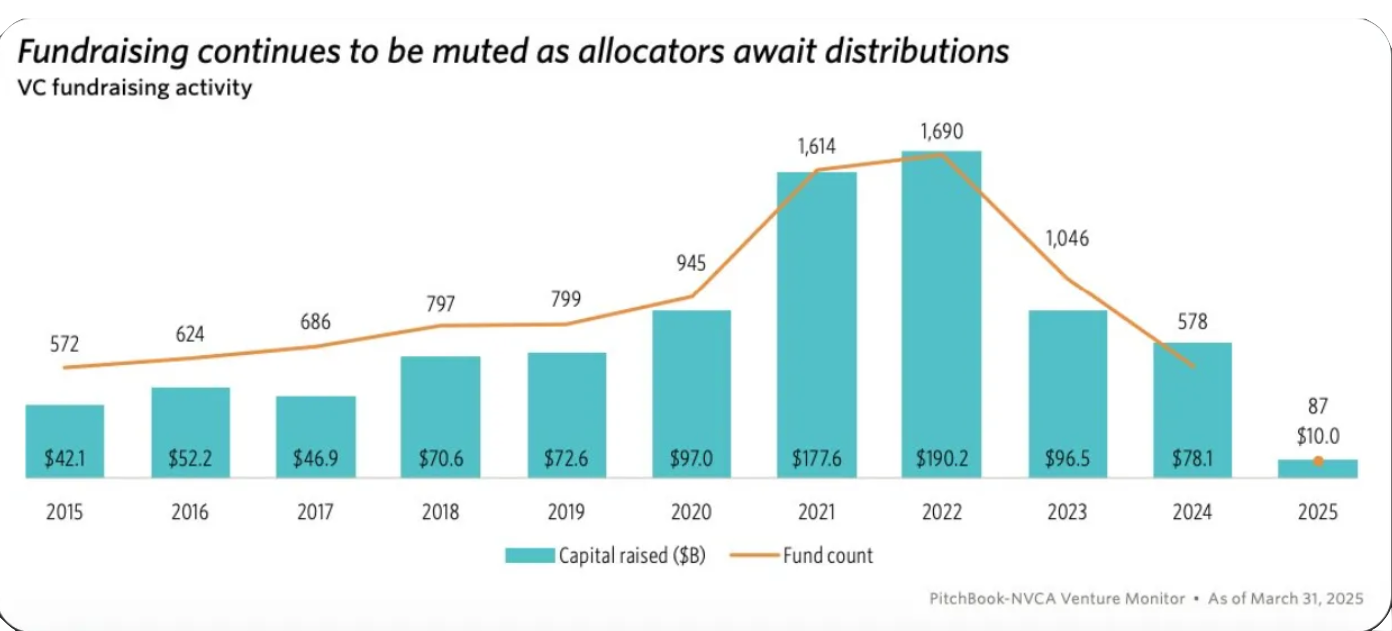

The golden age of classic VC is fading. With inflated valuations, stubborn liquidity bottlenecks, and AI reshaping the game board, the smartest firms—Lightspeed, a16z, Sequoia—aren’t just waiting for IPOs. They’re becoming operators.

Lightspeed has formally gone RIA, unlocking the ability to buy public stocks, do buyouts, and run roll-up strategies. a16z has already built wealth management, gone deep on crypto, and acted like PE with Twitter. Sequoia killed the 10-year fund. General Catalyst now calls itself a “Transformation Company.”

Key Takeaways:

LP Selectivity Up: Capital concentrated in top-performing or high-conviction managers; first-time funds struggled.

VCs Playing Defense: “Flight to quality” continued, with fewer early-stage bets and a focus on proven winners.

AI Still Hot: Artificial intelligence absorbed a disproportionate share of capital, propping up quarterly totals.

Geographic Clustering: Bay Area and NYC dominated deal flow, leaving less room for other regions.

Liquidity, Not Sentiment: The core issue isn’t confidence—it’s exits. Until public markets stabilize, VC will stay cautious and selective.

Liquidity, Not Sentiment: The core issue isn’t confidence—it’s exits. Until public markets stabilize, VC will stay cautious and selective.