Trump vs. Musk Turns Nuclear, China Chokes EVs, and Zuck’s AI Ad Machine Rattles Madison Ave

1.) Trump vs. Musk: The Billionaire Bromance Implodes

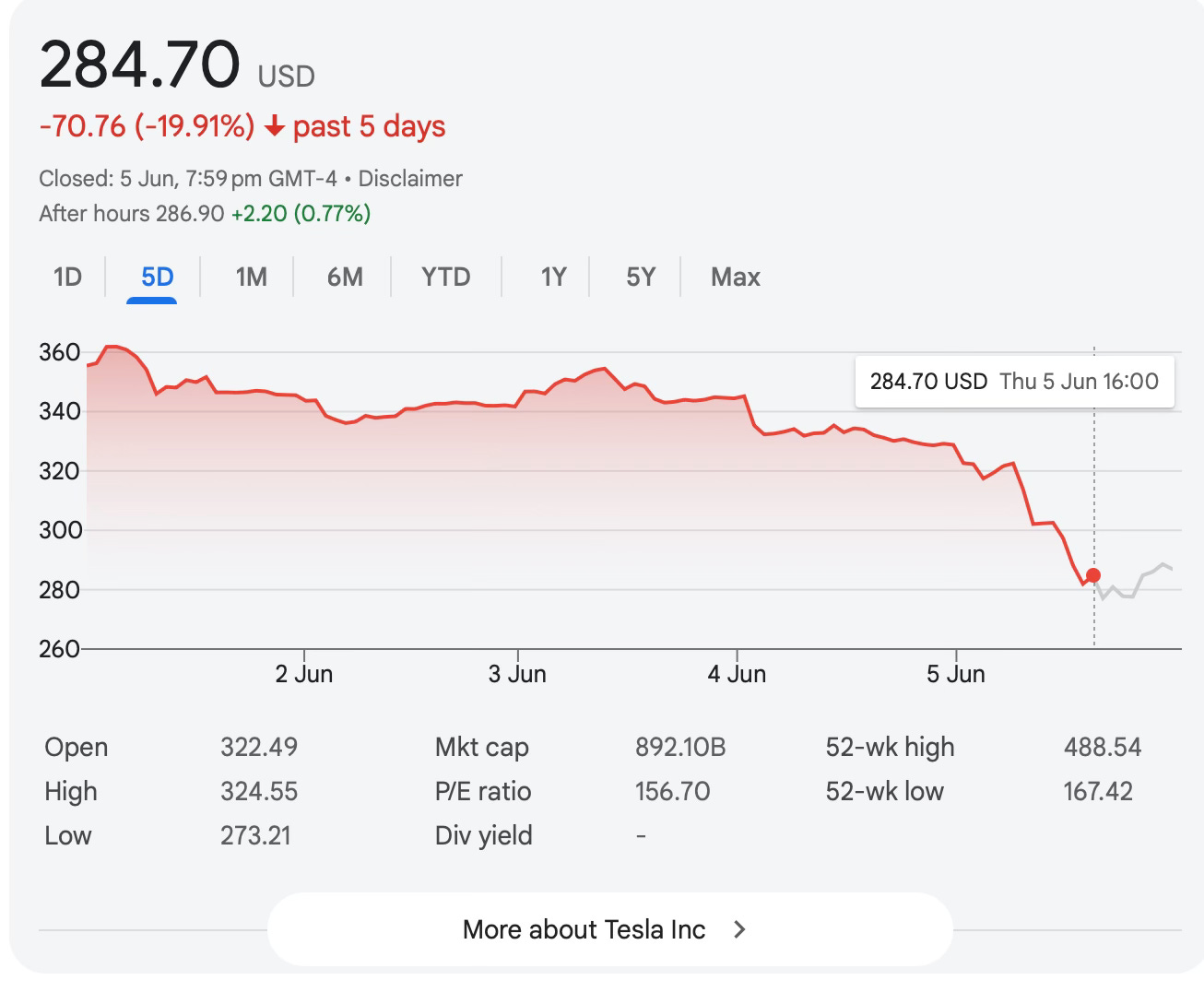

What started as a power duo shaping the White House has gone nuclear. President Donald Trump and Elon Musk—once allies in deregulation, budget-slashing, and backroom influence—are now locked in a brutal public feud that’s costing real money. After Musk blasted Trump’s massive new spending bill as “a disgusting abomination,” Trump hit back hard, threatening to axe all federal contracts with Musk’s companies. The fallout was immediate: Tesla shares nosedived 14.3%, wiping $150 billion in market cap—the largest single-day loss in Tesla’s history. Musk’s net worth shrank by $34 billion, though he still towers above Trump financially with $203 billion to the former president’s estimated $5.9 billion.

The drama spilled out across Truth Social and X, where Musk suggested Trump should be impeached and floated the idea of forming a new centrist political party. Trump, in return, accused Musk of missing his White House gig and caring only about EV tax credits. Behind the theatrics is a real threat to Musk’s empire—SpaceX’s Dragon capsule, which ferries astronauts to the ISS, could lose critical government contracts. Investors are spooked not just by politics, but by Musk’s shifting focus from rockets to rants. In the end, both titans are playing to their audiences, but only one’s portfolio took a rocket-powered nosedive.

2.) China’s Rare Earth Ban Stalls U.S. EV Makers

U.S. carmakers are in panic mode as China, which controls 99.9% of the world’s supply of heat-resistant EV magnets, halts exports to the U.S. in retaliation for Trump’s tariffs. With no good alternatives, automakers face costly decisions: either ship engines to China for assembly—defeating the point of reshoring—or revert to outdated, inefficient motor tech. The fallout has already shuttered a Ford plant in Chicago, with more closures likely if supplies stay frozen. The clean energy race just ran into a geopolitical buzzsaw.

3.) Meta’s AI Ad Machine

Meta is doubling down on AI to reinvent the ad industry. By the end of 2025, the tech giant plans to let advertisers generate entire campaigns—from product images to targeting—using AI alone. It’s a bold step toward full-stack automation, especially aimed at smaller brands with limited creative budgets. Real-time personalization based on location is also in the works, letting ads change dynamically depending on where you’re scrolling from.

AI-generated ads could replace traditional creative agencies

Meta aims to boost ROI for brands while locking them into its ecosystem

Critics worry it’s a closed-loop system with inflated performance claims

But trust is the elephant in the room. A $7B class-action suit over allegedly inflated ad metrics is moving forward, and ad executives remain skeptical. “They’re grading their own homework,” one said. Still, the move rattled legacy ad giants like WPP and Omnicom, whose shares dipped on the news. Whether it’s disruption or overreach, Zuck’s AI ad empire is coming—ready or not.