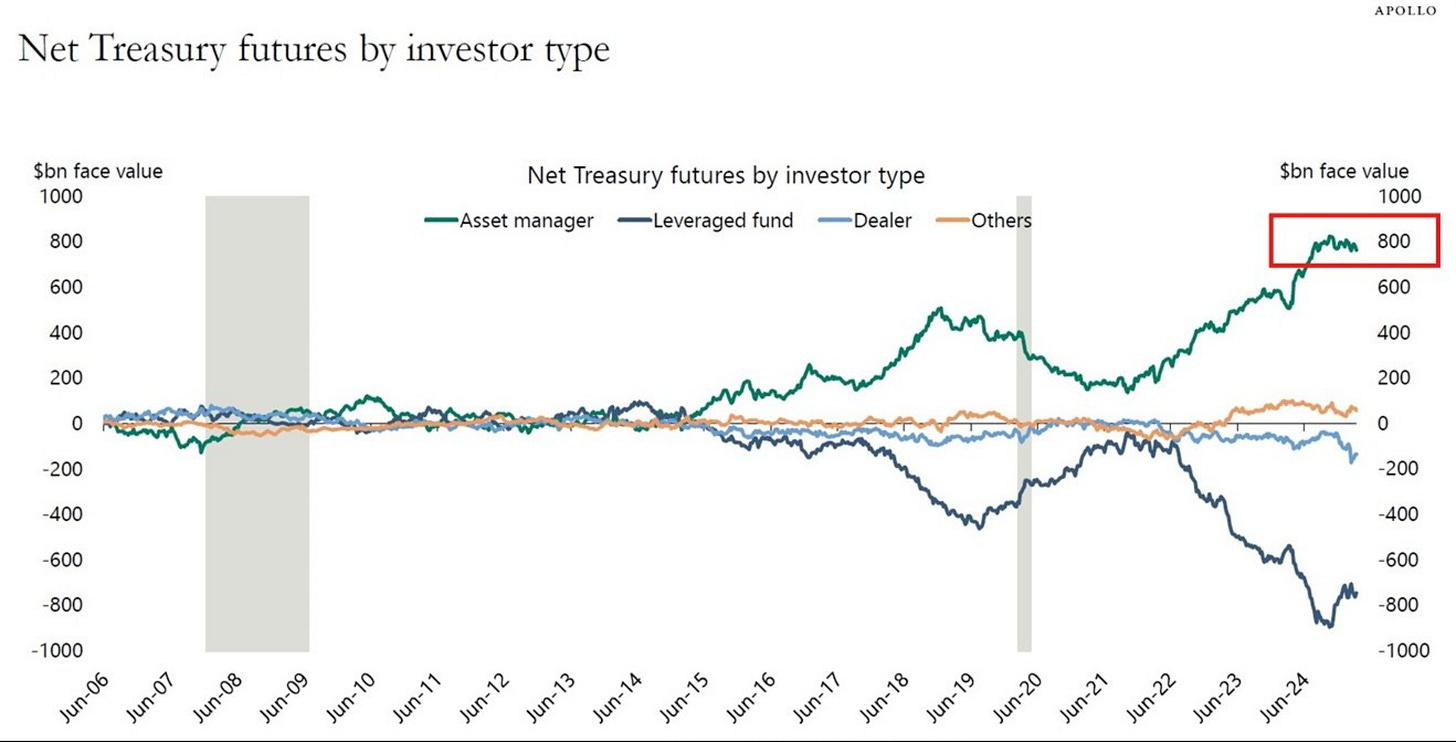

The $800 Billion Bet That Just Broke the Bond Market

The Bond Market Just Did Something It Hasn’t Since Reagan Was President

Something cracked in the bond market—and investors are scrambling to find out why.

In just three days, the 10-year Treasury yield skyrocketed by an astonishing 60 basis points. At the same time, the S&P 500 plunged 8%, marking one of the sharpest divergences between bonds and equities in modern market history.

So, what just broke?

The answer: the obscure but powerful “basis trade.”

Late last night, between 7 p.m. and midnight ET, chaos deepened. The 10-year yield jumped another 25 basis points, and the 30-year Treasury yield surged past 5%, even as stock futures tanked. These are not normal market jitters; they’re seismic moves signaling distress.

Historically, if a recession is expected—as it is now—investors rush into safe-haven Treasuries, pushing bond prices up and yields down. But we’re seeing the exact opposite. This unexpected leap has sent yields 60+ basis points above the levels observed when the Fed began pivoting toward rate cuts in September 2024.

The culprit behind the turmoil? A highly leveraged trade called the “basis trade.” Hedge funds typically use it to exploit tiny price differences between actual (“cash”) Treasuries and Treasury futures contracts—often magnifying these small gaps by leveraging their bets up to 100 times.

Sounds clever, right? In calm markets, it is. Traders pocket easy profits from these micro-discrepancies. But when volatility spikes, the basis trade morphs from an easy-win arbitrage into a ticking bomb.

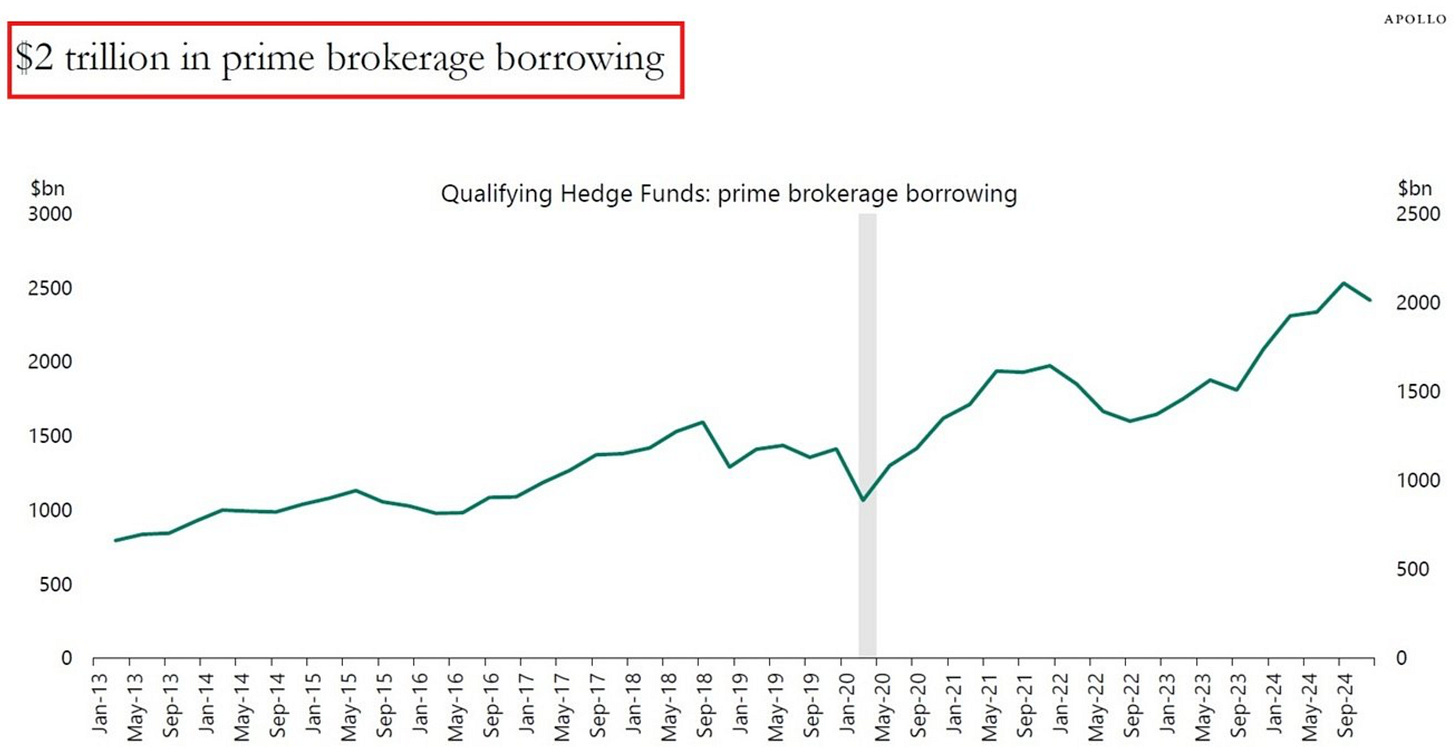

Currently, this basis trade exposure is massive—around $800 billion. That’s roughly 40% of the $2 trillion in positions managed by major prime brokers. As volatility surges, these leveraged bets unravel quickly, forcing broker-dealers, who are already stretched thin, to absorb huge shocks.

To complicate matters, the U.S. government continues flooding the market with Treasuries to finance ballooning deficits. More supply means lower prices, further pressuring broker-dealers who lack the balance sheets to handle this rapid deleveraging.

The result? A financial domino effect that’s rattling markets worldwide.

If you’re feeling jittery today, you’re not alone. Buckle up—this unwind might have just begun.

Key Takeaway:

The recent spike in Treasury yields might look, at first glance, like markets have flipped bullish, signaling a return to “risk-on” sentiment. But don’t be fooled—the real story is exactly the opposite. Investors aren’t celebrating; they’re panicking. As leveraged “basis trades” unravel, confidence in traditional safe havens is evaporating, sending traders scrambling for protection. That’s why gold prices are surging and significantly outperforming bonds (like $TLT). Gold is reclaiming its role as the ultimate financial refuge, underscoring that beneath the surface, the market’s nerves are fraying fast.

Important Disclaimers