1.) Tesla’s $5 Trillion Robot Play

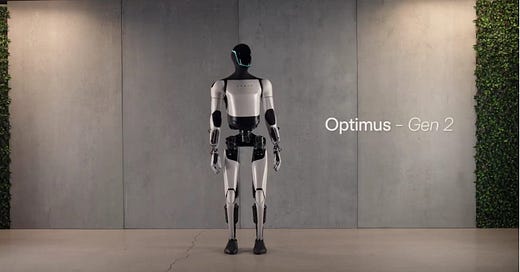

Tesla’s next moonshot isn’t a car. It’s Optimus—a humanoid robot Musk says could become the most valuable product in history. Morgan Stanley now pegs the humanoid robot market at a staggering $5 trillion by 2050, with as many as 1 billion units deployed globally. The real winners, they argue, will be those who own not just the hardware, but the “brains and branding” of the machines. That’s where Tesla has the edge.

Elon Musk plans to build 10,000 to 12,000 Optimus units this year alone. Even 5,000, he quipped, would match the size of a Roman legion—an army of machines ready to transform labor, logistics, and manufacturing. This isn’t just robotics—it’s a systemic reset. Tesla isn’t building products; it’s scripting history. As capital chases AI and robotics, Optimus may turn out to be Silicon Valley’s most audacious bet yet.

2.) BlackRock’s Blockchain Pivot

BlackRock isn’t just dabbling in digital—it’s wiring the plumbing of legacy finance for a blockchain future. The world’s largest asset manager just filed to tokenize a share class of its $150 billion Treasury fund, tapping distributed ledger tech (DLT) to mirror ownership and streamline ops. The twist? It’s not fully tokenized—yet. Settlement still relies on old-school books, but the direction of travel is clear: Wall Street’s quiet migration toward on-chain finance is accelerating.

BNY Mellon will act as the trusted middleman, managing tokenized shares with a $3 million minimum. Critics argue it’s fee-chasing in disguise. Others call it a Trojan horse for deeper adoption. Larry Fink isn’t shy: he believes “every financial asset will be tokenized.” With funds like BUIDL already live, and Ethereum likely the backbone, BlackRock’s DLT play isn’t a test—it’s phase two.

3.) Apple’s $900 Million Tariff Problem

Apple just posted its best Q1 in over two years—but the celebration may be short-lived. While revenue topped $95 billion, CEO Tim Cook warned that Trump’s new tariffs could cost Apple $900 million next quarter. China sales missed by nearly $1 billion, and Cook confirmed a production shift to India and Vietnam—one that won’t play well with Beijing. Analysts suspect the Q1 boost may have come from a pre-tariff shopping spree, though Cook downplayed that theory.

Meanwhile, Apple’s legal troubles are heating up. A federal judge accused the company of “willfully” violating a 2021 court order by designing new fees to block developers from bypassing the App Store’s 30% cut. The ruling was so scathing it suggested Apple’s execs could face criminal contempt charges. Cook’s silence on tariffs is over—but now he’s got two fronts to fight on.