Self Sovereign Money, Smart Contracts replacing TradFis, Bitcoin's 1 Trillion Market Cap

It's time to Talk About DeFi Again, TradFi Wind of Change

Welcome the Year of Tiger 🐯Everyone !

Welcome to our New 1,589 New Subscribers who have joined recently making us 21,382 Members 💪!

1. Self Sovereign Digital Money

We’re undergoing a seismic shift in all industries and public blockchains could transform every traditional asset classes.

Are we sensing some opportunity hereafter this massive sell-off in the crypto markets? Are we at the bottom yet in crypto?

But first, lets dive in to the foundation of “self-sovereign” digital money. Ethereum has expanded into two other revolutions

Financial (Defi)

Web3 Revolution

However, Singular believes replacing traditional institutions that rely on centralized authorities with decentralized, open. source software is still years away.

For instance, Bitcoin’s current price stability problem makes it difficult for credit and debt markets to form on top of it because every contract taking payments might need to charge a large premium to factor in price risk. Imagine you receive your salary of 0.2 BTC per month, if price of BTC drops like, in recent weeks, you might miss rent 😬…

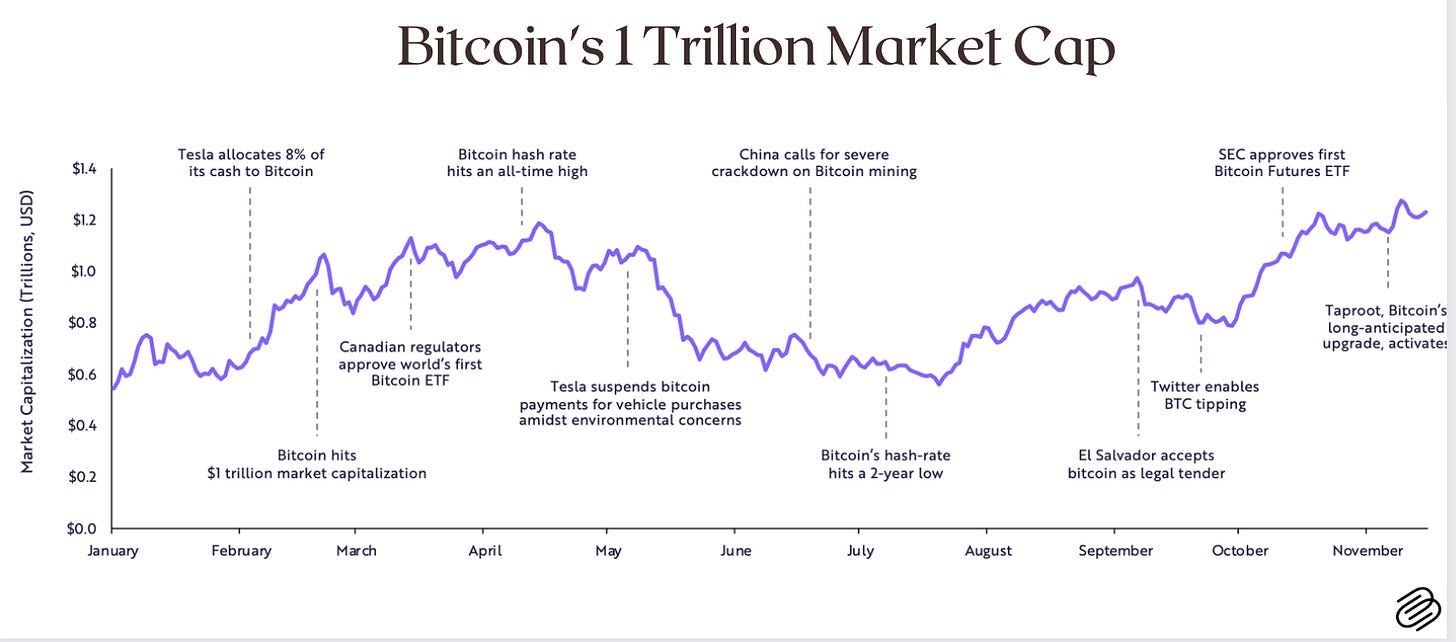

While Bitcoin still operates as a single, decentralized institution instead of relying on regulators, accountants, and governments because Bitcoin relies on a global network of peers to enforce rules. Though Bitcoin is still volatile, Bitcoin holders are focused on long-term fundamentals.

The one takeaway we have to give overall this macro noise while Bitcoin’s market participants are maturing and El Salvador, Tesla, MicroStrategy & Square are keeping them as a store of value and part of their balance sheet is this…

Bitcoin could exceed $1Mn by 2030…

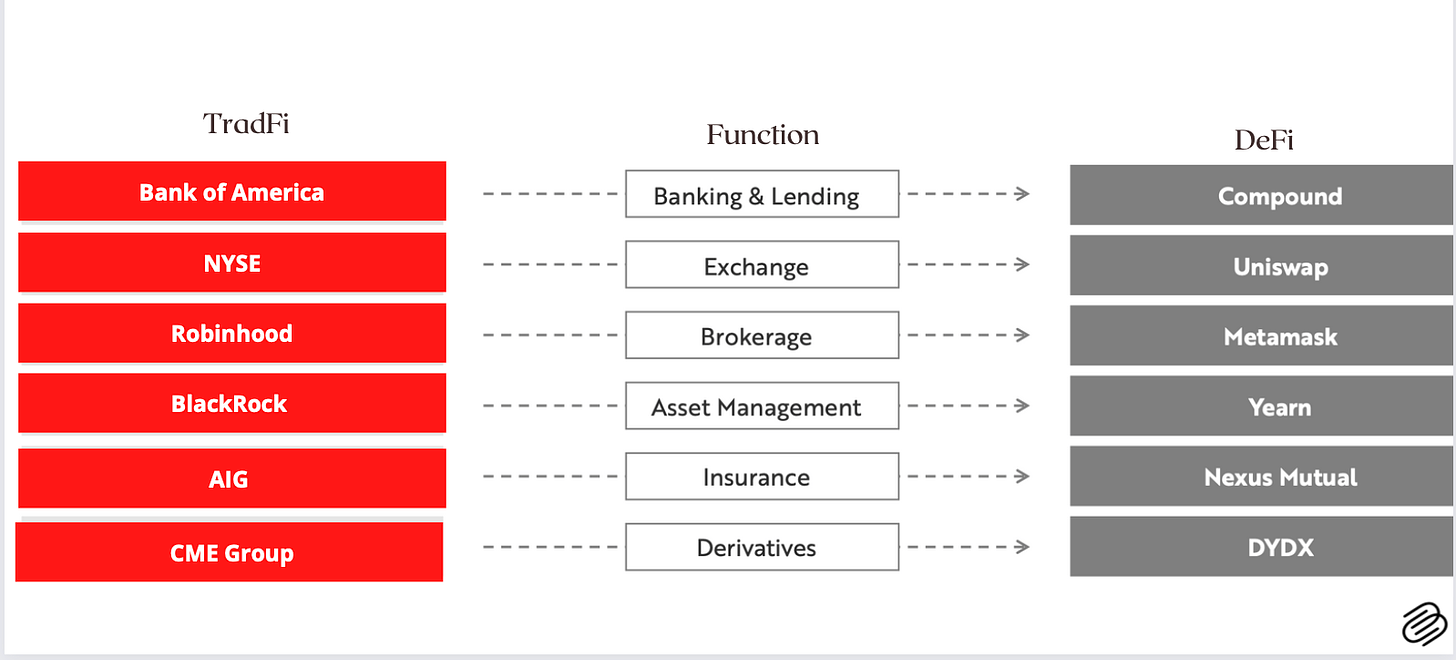

2. Smart Contracts vs TradFis

Now, everything DeFi meaning built first and foremost on smart contract platforms.

So what are smart contracts? Smart contracts are digital contracts stored on a blockchain that are automatically executed when predetermined terms and conditions are met.

Traditional finance (TradFi)

This week, we’ll cover the basic functionalities happening right now in the DeFi (Decentralized Finance) space.

Smart Contracts 👉 Open & Transparent

TradFi 👉 Highly regulated networks , Central Government, Lack of Scale.

Bitcoin 👉 A scarce digital asset

DeFi 👉 Feature Rich, permissionless & composable.

So let’s get started!

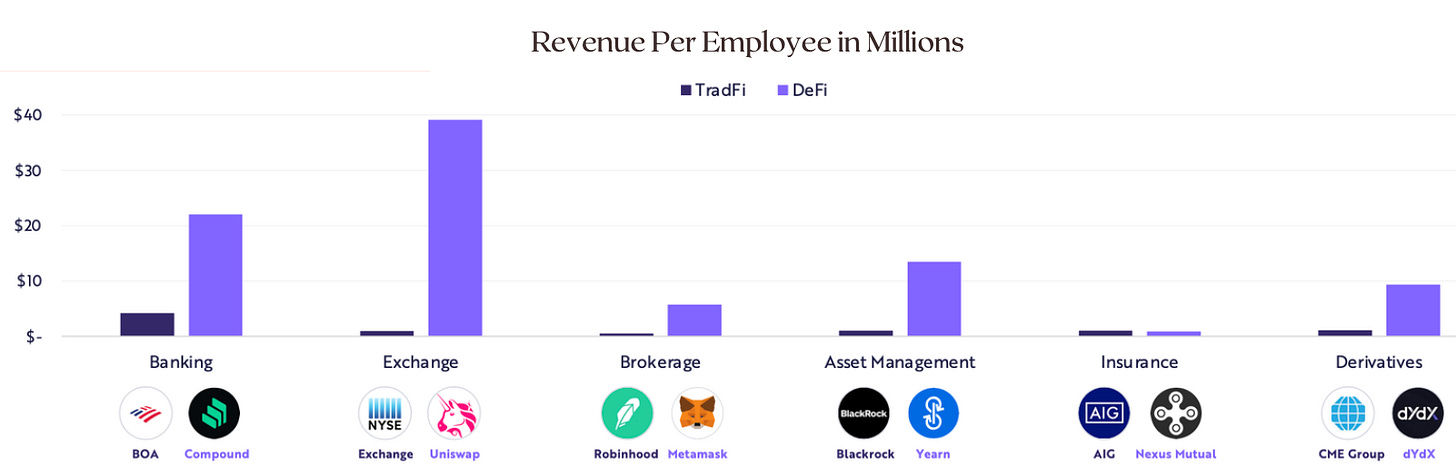

3. DeFi eating TradFis

If you look at the rapid acceleration of DeFi apps in the last 1 year, smart contract-based financial transactions are like the Ferrari of Finance almost anywhere in the world. It looks like people still trust centralized entities when it comes to money, but we’re seeing a new wave of DeFi apps that has unlocked a faster, more efficient and transparent way of financial transactions

Wrapping Up…

Singular believes DeFi will continue to mature to a point where it becomes a standard for global settlement and financial transactions. Once that happens, growth in DeFi startups will occur in two phases: 1) investing in high-quality projects in DeFi 2.) Once the rebound in overall crypto markets takes hold, invest in high-growth DeFi companies tokens that dominate their niche and are positioned in this fast-growing industry as DeFi still represents a small fraction of global assets.

P:S Bitcoin’s annual settlement has already surpassed Visa’s payment volume, Singular believes Bitcoin will continue to scale in response to technological breakthroughs in remittance, nation-state treasury, institutional investment, and as digital gold. The long-term outlook for Bitcoin looks great!

Until Next Time…

… Down to Gorky Park

Always Listen to the wind of change… -Scorpions, Crazy World