Rise of DeFi Mullets, Web 3 Layer, DAOs Eating the World

Fintech Startups vs Banks, Web 3.0 on top of Web 2.0, The People's DAO

Happy Tuesday Everyone 🌅!!!

THREE Things you need to know this week.

1.) DeFi Mullets Disrupting Traditional Banks

This week, Fintech startups are already overtaking banks as those startups continue to revolutionize the finance industry. Fintech startups are at the forefront of innovation in the blockchain and NFT markets. DeFi sectors of crypto have grown from $1.7B to $250B in Total value Locked (TVL) in the past 15 months!

Top Fintech apps on Apple App Store November 24th 2020 (Adapted from @sethginns)

Introducing DeFi Mullets coined by Bankless where Fintech is growing out its DeFi Mullet with an easy to use UI & UX on the frontend but with a more open infrastructure in the backend which will lead to 90x improvements.

It’s clear that Banks are getting Disrupted by DeFi Fintech Companies but Crypto is just getting started

So when will DeFi become intelligent? 🧠

Murphy’s Law, which states that “anything that can go wrong will go wrong”, has certainly applied to the a huge glitch on DeFi platform like Compound or SushiSwap over the last 2 years.

This had led to a counterparty risk nightmare— leaky pools, loss of users confidence (thanks Compound!), glitches, etc—that has every DeFi supporter rethinking whether they can rely on “smart contracts” and distribution networks.

It also led to hacker of this high-profile error in DeFi taking around $600 million worth of tokens and later returned the stolen amount. Yes, there are reasons to critise the existing banking system but the shortcomings of DeFi has led to disasters for users as Crypto Bros’ adage of “Code is law” often overlooks the vulnerabilities and erroneous code.

Over $24B in venture funding for supply-chain tech companies through the first 3 quarters of 2021. That’s 58% more than all of 2020 before all of these vulnerabilities were exposed and these startups were overlooked.

The focus here is to leverage DeFi technology with a simplified UI & UX to help individuals and businesses manage payments and financing more efficiently and transparently. Think more frictionless and user-friendly Fintech Apps.

According to Statista, from 2018 to 2021, the number of fintech companies in the EMEA region nearly tripled. And in 2018 alone, a total of $254 billion was invested globally into roughly 18,000 fintech startups

Singular’s TAKE: Crypto & DeFi is already happening, remember when most people call the internet a fad? Recall that “I Told You So” Guy who is now reminding everyone he told you to buy Bitcoin 8 years ago at $1? Crypto & DeFi true cost is impossible to ignore.

Singular’s ACTION: Good news if you missed the Bitcoin wave, Decentralized Finance or DeFi is being said to be potentially more disruptive than Bitcoin itself confirmed by Bank of America.

2.)How to Build a Web 3.0 on Top of Web 2.0

While most Web 2.0 platforms today include social networking sites, Wikipedia, and YouTube. The third generation of the internet called Web 3.0 is a concept of edge computing built on top of the blockchain, cryptocurrencies, NFTs, and other technologies. So is Web 3 already here? While there is no solid definition of Web 3, we are seeing existing Web 2 companies transitioning into Web 3 to reshape the web.

3.) The People’s DAO

Decentralized autonomous organizations or DAOs are now the hottest thing since NFTs. We have seen in the first 10 months of 2021, sales of NFT skyrocketed into $27 B in total, that’s a boatload of money for JPEGs!

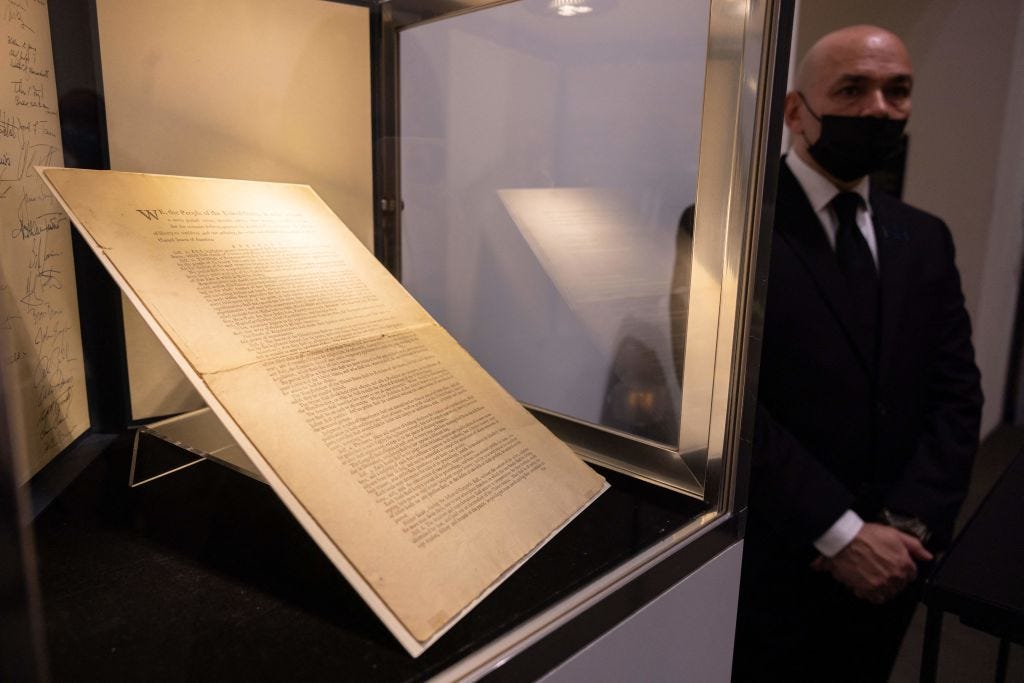

Recently a DAO is looking to buy an NBA sports team. They tried to buy the Constitution when the rare asset went up for auction: the First-edition US Constitution sold for record $43.2Mn to Citadel CEO Ken Griffin instead.

The first sentence in this article stated that the largest organization in the world will eventually be a DAO. Well, we believe this, the Consitution DAO was set up in less than 48 hours raising $5 million initially. We have seen online communities like Reddit forum WallStreetBets, NFTs acting much like internet memes where people are paying $10.2 M for a piece in 2021, DAOs are a novel way for humans to coordinate with one another where an organization is governed by a set of rules written in smart contracts and controlled by its participating members.

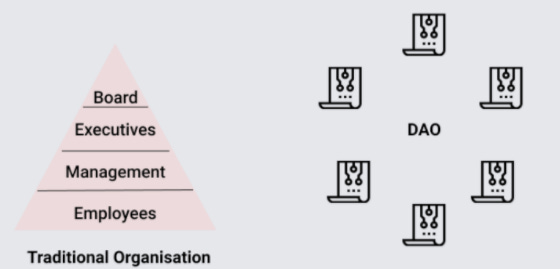

Let’s simplify this further. As crypto bros looking to reinvent traditional organizations, DAOs can take a number of forms depending on its intent and purpose.

Social DAOs (Built around the community)

Protocol DAOs (collective entities to help a protocol)

Investment DAOs (for-profit business that invests in assets or companies)

Singular’s TAKE: We’re still early when it comes to DAO infrastructure. ConsitutionDAO started as a joke but they showed the entire world amazing things crypto can unlock and built an incredible community.

Singular’s ACTION: What’s next for DAO? We will see even more DAOs being set up in 2022 serving different use cases. Conventional old crowdfunding campaigns will be the most popular use case of DAOs.

A recap DAOs will become the next big trend in decentralization with the following traits

Transparent smart contracts on the blockchain run from the bottom up instead of top-down (Think traditional organization where there is typically a hierarchy, in DAOs there are decentralized)

“Trustless” with a pre-established set of rules and will execute when conditions are met

DAOs will typically sell native tokens to build up a treasury and buyers of those native tokens having voting power or membership

Until next time,

Remember, It’s Never Too Late to Be Early!