Reasons FTX Collapsed, BTC in deeply Undervalued Territory, ETH Remains Strong

FTX files for Bankruptcy, BTC Undervalued, ETH Fundamentals

Good Morning Everyone!

2022 has been a brutal year for Tech and Crypto, with the collapses of crypto titans like Terra, 3AC, and FTX went from billions of dollars valuation to zero virtually overnight. Prices in crypto are down from its peak by as much as 71% and we have seen $2.2 trillion being wiped out in less than a year.

By Terrence Hooi

Chief Investment Strategist

This Substack Post does not take into account nor does it provide any tax, legal or

investment advice or opinion regarding the specific investment objectives or

financial situation of any person.

This week we are covering what went wrong and why the collapse of FTX caused a liquidity crisis and forced selling by Binance to liquidate all of FTX’s native token FTT.

1.) FTX from $32B to Bankruptcy in One Week

What just happened to FTX?

This week Bankman-Fried steps down as CEO and FTX files for bankruptcy. The scale of the credit crisis in May-July of this year following the collapse of Terra.

Firstly, a suspected hack for “unauthorized transactions’ on FTX cold storage and authorities suspected that about $477 million was stolen from FTX. Next FTX had a surge of customer’s withdrawals earlier this month. Bankman-Fried even used FTC funds to buy personal items, homes in the Bahamas as court filing wrote in the declaration.

Here’s a summary of FTX’s internal controls

FTX, a company valued at $32 Billion never had any board meetings

Party loans were given internally where Alameda Research (FT’s hedge fund division) gave Sam Bankman-Fried a $1 Billion loan and Director of Engineering Nishad Singh a $543 million loan .

Employees submitted expense over chat and random manager would accept or reject using EMOJIS 😉🥸😎🤓🤩

FTX had zero cash management system meaning the company had no idea how much cash they had or where their cash was.

No employees records whatsoever

Corporate funds used to purchase real estate with executives names on it

Sam Bankman-Fried’s erratic and misleading public statement including stated a reporter on Twitter “F*** regulators they make everything worse.”

The fall of FTX might kick-start a second contagion effect following the collapse of Terra and the collapse of FTX reverberated across the crypto world sending cryptos like BTC, ETH plummeting this week.

This created a new wave of forced selling as investors last resort to unwind their positions and deleverage their holdings since the destruction of Terra’s stablecoin UST.

Singular’s Take: As regulator has frozen FTX’s assets in the Bahamas, a class one action lawsuit has been filed with Sam Bankman-Fried named along other celebrities who have promoted FTX in the past, including Tom Brady, Larry David, Naomi Osaka, Shaquille O'Neal, and Stephen Curry. The financial services Committee will begin hearing as soon as December.

Singular’s Action: The CeFi industry has seen some bankruptcies and FTX could be the ‘grand finale” before we see deleveraging happens in the industry. Largely players with massive leverage could go under during this massive implosion of FTX. Credit across Crypto and CeFi will be much tighter now following those events. FTX down to Zero.

2. BTC Deeply Undervalued

Singular believes that BTC is bottoming out due to a variety of on-chain analytics and quantitative indicators. While we may see some bankruptcies in CeFi, this will not add near-term sell-pressure to the overall crypto market and assets held by bankrupt companies will soon be auctioned off at rock bottom prices in the upcoming weeks.

Yes, we are seeing the risk of end-of month selling pressure as a result of fund redemptions but this impact is likely fading out our most funds redeemed has most likely filed for bankruptcy.

Two metrics to track

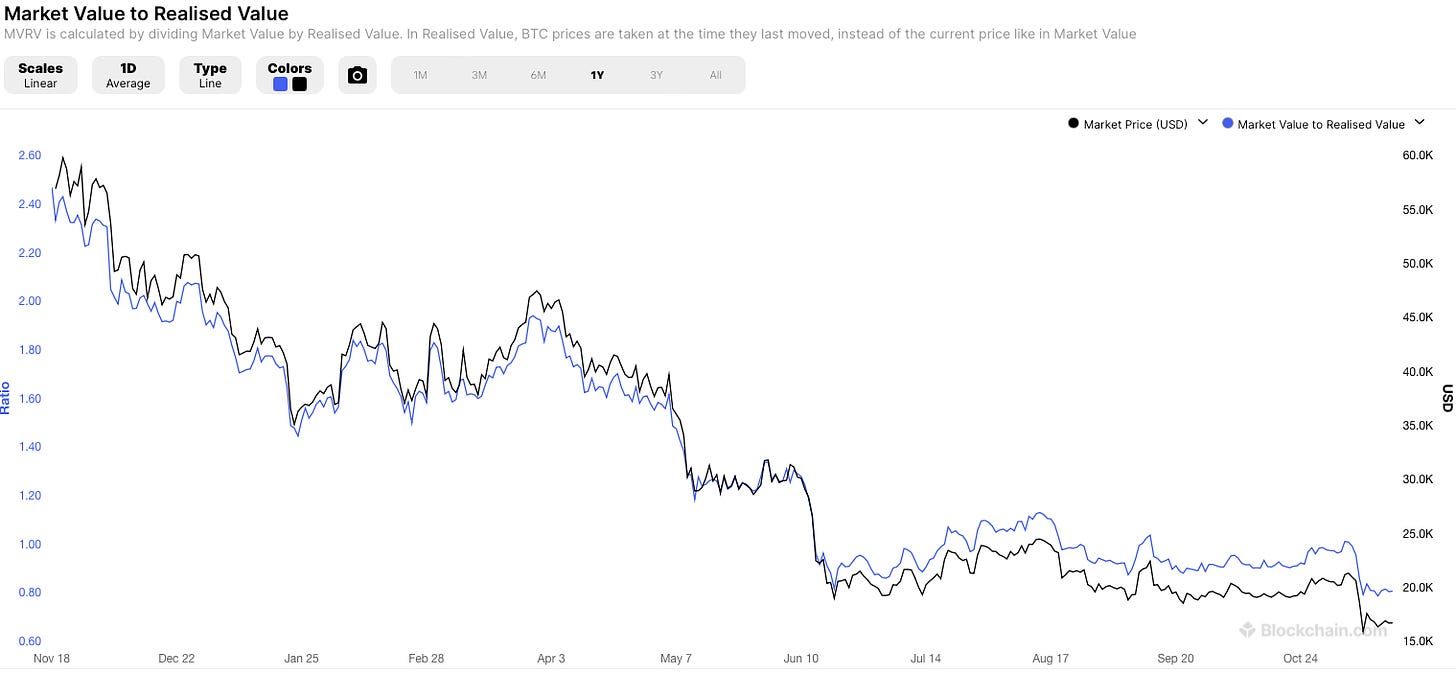

Market Value to Realized Value (MVRV) is a ratio of an asset's Market Capitalization versus its Realized Capitalization. By comparing these two metrics, MVRV can be used to get a sense of when price is above or below "fair value", and to assess market profitability.

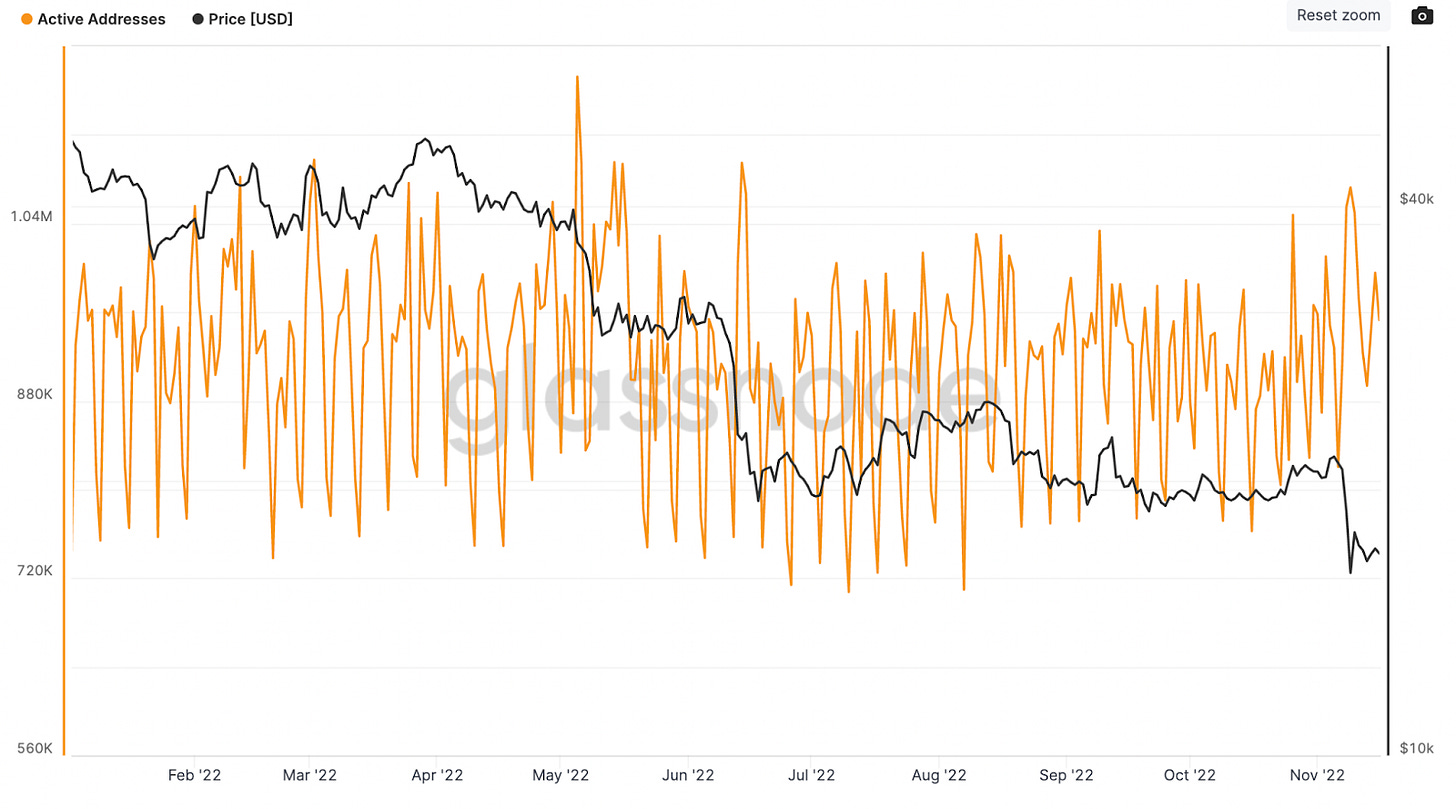

Bitcoin’s Daily Active Addresses, which spiked to 1.07M on November 9, the day of the *current* local bottom. This represents the high single day total since this summer’s crash meaning new buyers are coming into the market.

Singular’s Action: Long BTC. Bitcoin is in value territory when MVRV dips below $1, as it suggests that most investors are underwater and therefore more likely to hold their positions in the medium term with this correction.

3. ETH’s Fundamentals Remains Strong

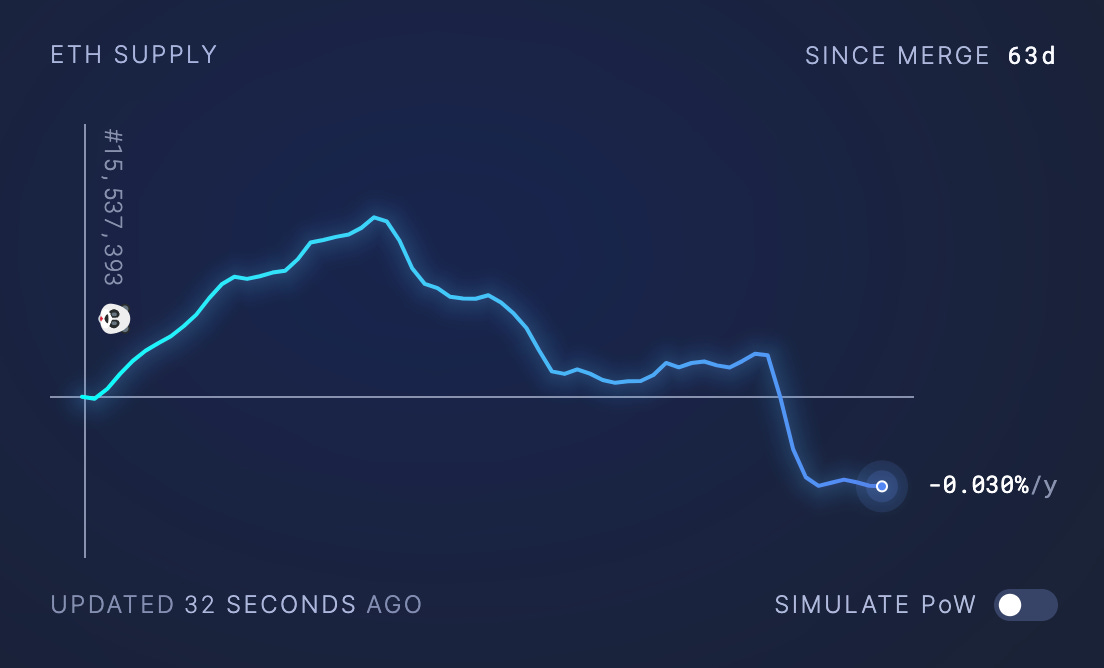

This week, Ethereum’s strong fundamentals also suggest that the bottom may be in. If we look at the overall ETH market structure following the FTX collapse, it was still higher than 3AC and Celsius blowup. In other words, ETH as ultra-sound money has a net deflationary issuance.

With DEXs facilitated billions in trading volume, DeFi protocols remain strong with major lending marketplaces like Aave remaining fully solvent and deep liquidity.

Singular’s Take: We are seeing improving macro suggesting that the bottom may be in and fundamentals of DeFi and DEXes remain strong.

Singular’s Action: ETH along with BTC is in undervalued territory. We are seeing ETH just reclaimed the 200 Week MA and for the rally to be sustainable, ETH has to stay above the 200 MA . We’re seeing post-LUNA and FTX deleveraging coming to an end with strong on-chain signals. technical and quantitative factors which is bullish for BTC and ETH. Long on Dips for both with 1-2 year horizon.

Snapshot of FTX Collapse

FTX (Bahamas unit) files for Chapter 15 bankruptcy protection

FTX Hacker swapped 34,000 BNB for 4,500 ether and 3 million BUSD

BlockFi prepares for the worst (bankruptcy) possible ‘significant exposure’ to FTX

Solana -55% Month to Date, worst performing crypto in recent weeks

NFT Platforms using Solana also dropped by 33% Week over week.