By @0xHooi

Chief Investment Strategist

The below is the opinion of the authors. Any conclusions are their own. This should not be considered as investment advice. Investing involves the risk of loss and returns are not guaranteed.

1.) Nvidia’ Trillion Dollar Problem

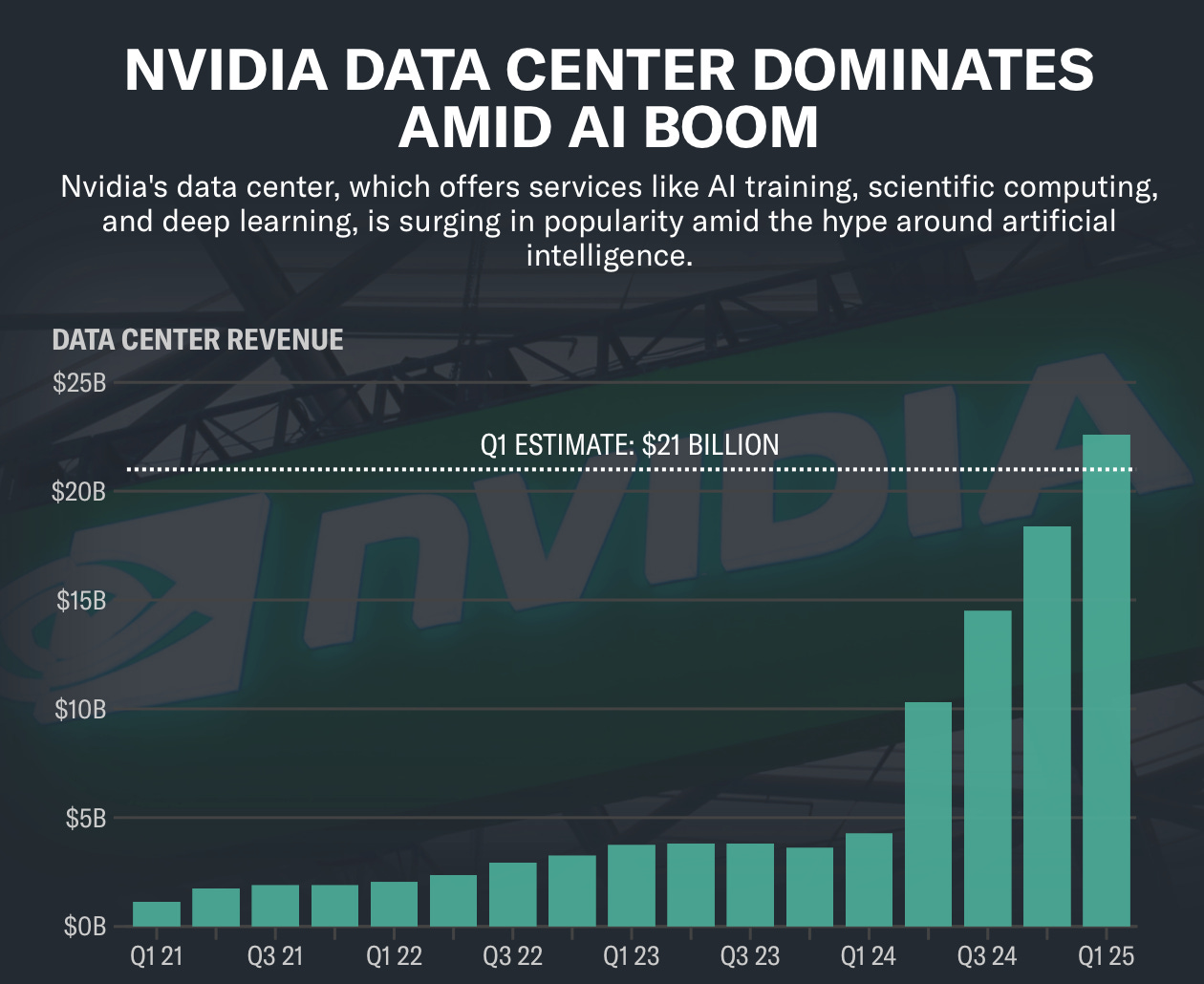

Nvidia recently reported an outstanding quarter with revenue and net income both rising significantly, leading to a surge in its stock price above $1,000. The announcement of a stock split in early June further excited investors by making shares more accessible. Nvidia’s leadership in AI chips is driving demand from companies and governments, reinforcing its strong market position.

Singular’s Take: Nvidia faces a major challenge in keeping up with the growing demand for its AI chips and systems. CEO Jensen Huang emphasized the company's relentless effort to meet this demand, acknowledging the risk of losing customers like Amazon and Meta, who are developing their own AI chips. Despite this, the company's commitment to innovation and annual new chip releases aims to sustain its market dominance.

2.) Mt. Gox Awakens: $2.9B Bitcoin Transfer

Mt. Gox, the defunct cryptocurrency exchange, has made headlines by transferring approximately 42,830 BTC, valued at around $2.9 billion, from its cold wallets to an unknown address. This significant transfer marks the first movement of funds from Mt. Gox in over five years, generating substantial interest and speculation within the crypto community.

The transfer is believed to be part of Mt. Gox’s ongoing efforts to distribute its holdings to creditors. The exchange, which filed for bankruptcy in 2014 following a massive hack, is set to distribute 142,000 BTC and 143,000 BCH to creditors before October 31, 2024. This move is seen as a crucial step in the long-awaited restitution process for those who suffered losses during the exchange’s collapse.

The recent transfer underscores the complexities and lengthy process involved in the legal and logistical efforts to return funds to affected users. For many, this movement of BTC signifies hope for the eventual recovery of their assets. As the distribution deadline approaches, all eyes will be on Mt. Gox’s next steps and the potential impacts on the broader cryptocurrency market.

3.) Former FTX Executive Sentenced

Former FTX executive Ryan Salame has been sentenced to 90 months in federal prison, followed by three years of supervised release, and ordered to pay $11M in fines and restitution for his involvement in the illegal activities at the now-bankrupt exchange.

Salame, who served as a high-ranking officer at Alameda Research and later as co-CEO of FTX Digital Markets Ltd., pled guilty last September to charges of unlawful political contributions, defrauding the Federal Election Commission, and operating an unlicensed money-transmitting business. He was part of a scheme to mis-categorize funds from Alameda, which were used for over 300 political donations aimed at gaining right-wing support for pro-FTX legislation. Additionally, Salame and other FTX employees transmitted customer funds without a license and made false statements to US banks. His sentencing serves as a reminder that no one is above the law in the crypto market.

Up Next: BlackRock Submits Updated Spot Ethereum ETF S-1 Application

Meme of the Week:

Important Disclaimers

The information provided in this Substack post regarding Singular Disrupt ("Singular Disrupt" or the "Company"), its crypto-assets, business assets, strategy, and operations, is intended for general informational purposes only. It does not constitute a formal offer to sell or a solicitation of an offer to buy any securities, options, futures, or other derivatives related to securities in any jurisdiction. The content of this post is not governed by securities laws.

The information contained herein should not be relied upon as advice to buy, sell, or hold securities or as an offer to sell such securities. It does not provide tax, legal, or investment advice or opinions regarding specific investment objectives or financial situations. Singular Disrupt, its agents, advisors, directors, officers, employees, and shareholders make no representations or warranties, expressed or implied, as to the accuracy of the information provided. Singular Disrupt expressly disclaims any and all liability based on such information or any errors or omissions therein.

Singular Disrupt reserves the right to amend or replace the information contained in this Substack post, in whole or in part, at any time, without any obligation to provide access to the amended information or to notify recipients. This post supersedes any prior Substack post or conversation concerning the same or similar information. Any information, representations, or statements not included herein should not be relied upon for any purpose.

Neither Singular Disrupt nor any of its representatives shall have any liability, under contract, tort, trust, or otherwise, to you or any person, resulting from the use of the information in this Substack post by you or any of your representatives, or for any omissions from the information provided herein. Furthermore, the Company undertakes no obligation to comment on the expectations or statements made by third parties regarding the matters discussed in this Substack post.