Ethereum: The Backbone of Modern Finance

Ethereum may be the most disliked asset in crypto circles right now, but behind the scenes, it’s quietly becoming the operating system for global finance. While skeptics point to sluggish price action, the world’s biggest institutions—BlackRock, Visa, Deutsche Bank, Alibaba, even Coinbase—are building on Ethereum. The narrative is shifting: not from hype to utility, but from speculation to infrastructure. Strip away the noise, and what’s left is clear—Ethereum isn’t competing with Bitcoin; it’s absorbing the financial internet.

Ethereum’s Inflection Point: A Setup Worth Watching

Ethereum is once again testing a familiar structural pattern—an extended range, a deviation below support, and the potential for a reclaim. Historically, this is the point where conviction pays: early capital positions at the lows, while the majority only flips bullish after ETH is halfway back into the range. If reclaimed, this range low often acts as a launchpad for sharp repricing across altcoins.

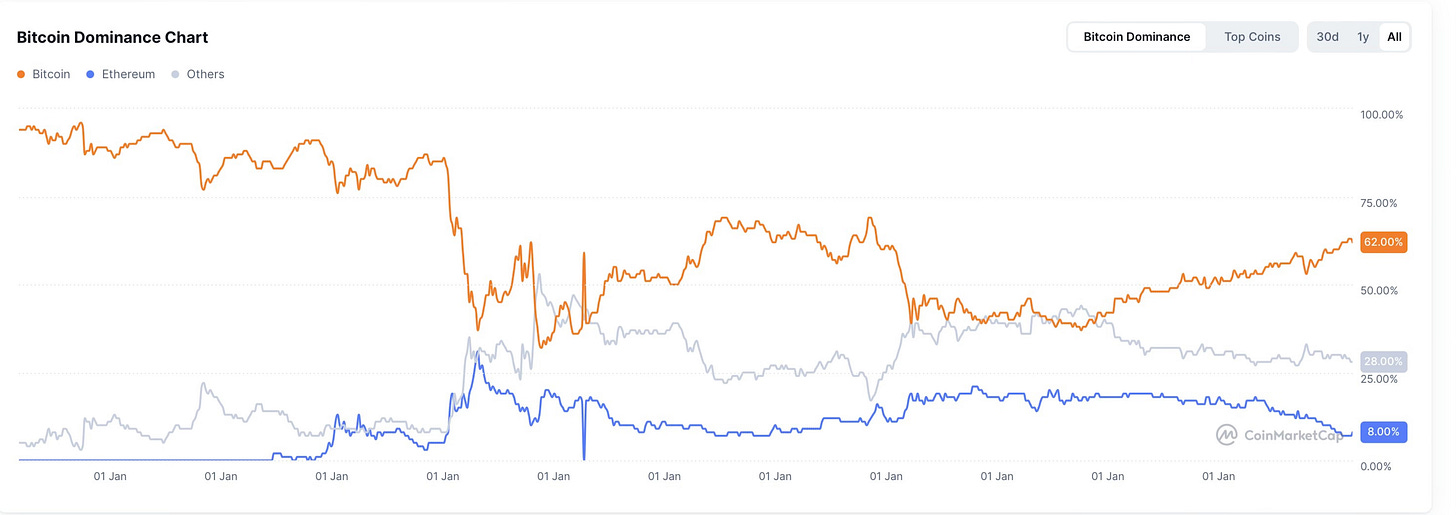

Bitcoin dominance typically peaks before altseason begins

Altseason starts not when ETH is strong, but when BTC starts to bleed dominance

Reclaiming key levels shifts risk-reward from waiting to sizing up

No macro catalyst needed—structure and timing often lead

TL;DR: If ETH reclaims this range, history doesn’t wait. Neither should you.

Important Disclaimers

The information provided in this Substack post regarding Singular Disrupt ("Singular Disrupt" or the "Company"), its crypto-assets, business assets, strategy, and operations, is intended for general informational purposes only. It does not constitute a formal offer to sell or a solicitation of an offer to buy any securities, options, futures, or other derivatives related to securities in any jurisdiction. The content of this post is not governed by securities laws.

The information contained herein should not be relied upon as advice to buy, sell, or hold securities or as an offer to sell such securities. It does not provide tax, legal, or investment advice or opinions regarding specific investment objectives or financial situations. Singular Disrupt, its agents, advisors, directors, officers, employees, and shareholders make no representations or warranties, expressed reor implied, as to the accuracy of the information provided. Singular Disrupt expressly disclaims any and all liability based on such information or any errors or omissions therein.

Singular Disrupt reserves the right to amend or replace the information contained in this Substack post, in whole or in part, at any time, without any obligation to provide access to the amended information or to notify recipients. This post supersedes any prior Substack post or conversation concerning the same or similar information. Any information, representations, or statements not included herein should not be relied upon for any purpose.

Neither Singular Disrupt nor any of its representatives shall have any liability, under contract, tort, trust, or otherwise, to you or any person, resulting from the use of the information in this Substack post by you or any of your representatives, or for any omissions from the information provided herein. Furthermore, the Company undertakes no obligation to comment on the expectations or statements made by third parties regarding the matters discussed in this Substack post.