DAOs Balance Sheets , Massive DeFi Hack "Wormhole", EV Boom & Raw Materials Shortage

Lithium, Copper , Cobalt, DeFi Protocol Vulnerabilities

Hello Everyone 🌠!

3 Things This Week

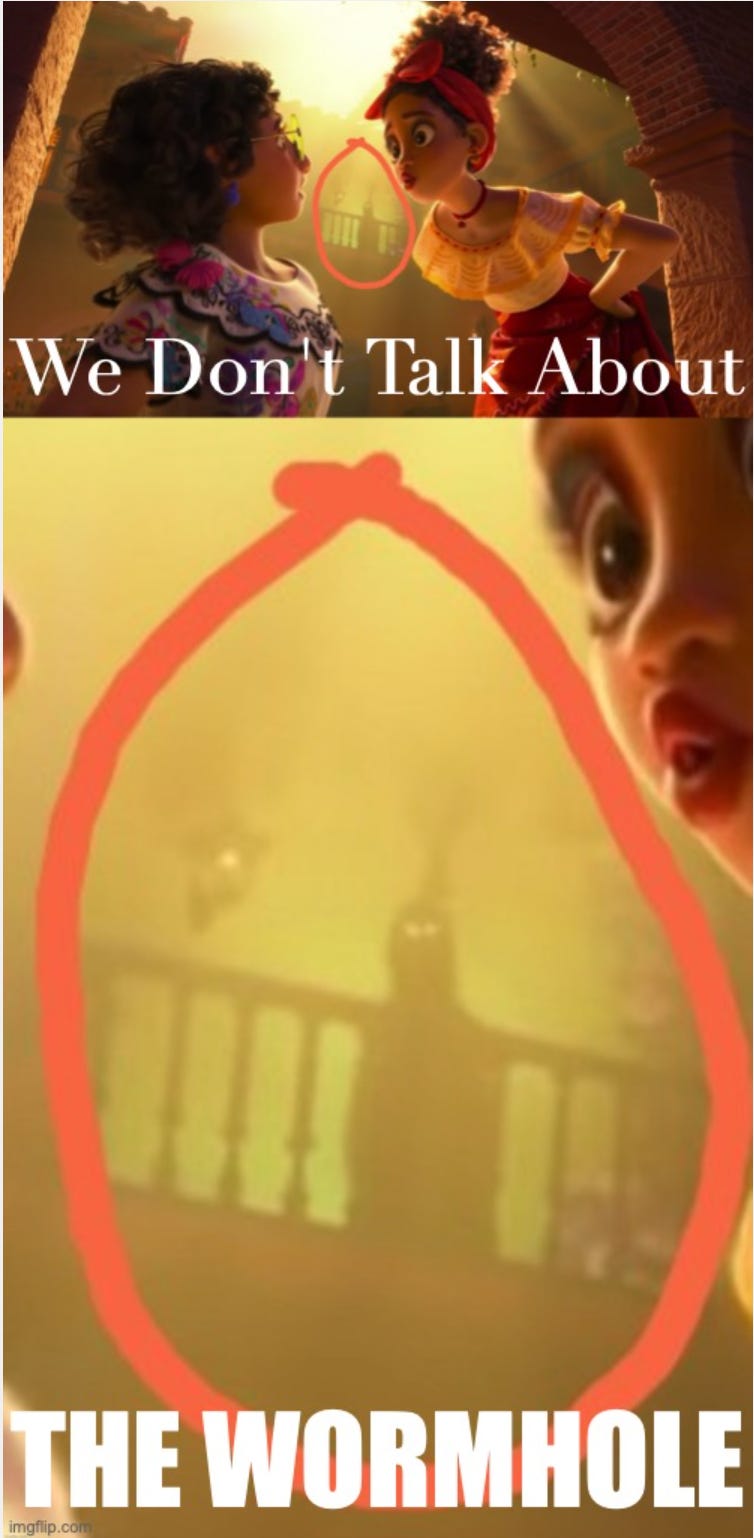

1.) 2nd DeFi Hack “Wormhole” Exposes Vulnerabilities

In the second largest DeFi hack to date, hackers stole $320 million of ether from Wormhole Protocol last week, a bridge that “connects” the Ethereum blockchain to Solana.

The first hack took place last August when $600 million worth of tokens was stolen from the Poly Network platform but the hacker decided to return all the money as their aim to expose flaws in the DeFi protocol.

What is a DeFi Bridge?

A DeFi bridge is designed for public blockchains like Ethereum, Solana and Avalanche to communicate with one another such that tokens and smart contracts “native” on one chain and interact with each other.

Here’s what happened last week.

On one side of the bridge where user has deposited Ethereum, before converting it to “wrapped ether” , the other side Solana seems to be vulnerable as hacker minted 120k of wrapped ether from nothing and cashed them for 120k ethereum. As a result 120k of native Ethereum side has been emptied from the Wormhole protocol. In the DeFi world, building bridges is still complex and expensive, but that is improving as teams with expertise with multiple contract languages and security models are refining DeFi bridges and protocols.

Lexikat’s Take: If you lost money in the Wormhole hack, then the best time to get some of it back was probably… in the immediate aftermath of the Wormhole hack. Events like this can have a serious long-term impact on stock prices when they happen to a corporation.

Here’s What We Found: Research has shown that it can take nearly half a year for share prices to hit a low point following a data breach, losing around -3.5% on average. Inexperienced investors often apply rules-of-thumb acquired in stock trading to the crypto market, however, this is one case in which that approach just doesn't work. In crypto, when a security crisis occurs, sentiment and price will dip briefly, but then recover quickly. In other words, taking advantage of such moments to buy the dip tends to be a reliable long-term strategy.

2.) DAOs are the new companies. What's on their balance sheets?

In our previous post, we wrote about DAOs replacing Traditional Corporations in a decentralized way. Where DAOs really shine relative to traditional companies is that they can support many contributor engagement models at once.

Here at Singular DAO, we ran an experiment and have found contributors flourish. when they can contribute to one single project without distraction instead of flowing. between projects or work as a freelancer on Upwork or similar.

How It Started

ConstitutionDAO had begun as a joke on Twitter, but it ended up legitimately participating in the Sotheby's auction and had successfully raised US$47 million for an artifact originally estimated to fetch up to only US$20 million — it could have won.

How It’s Going

Today the Top DAO projects like UniSwap started in 2018 has a Treasury of more than $5Bn. BitDAO reported to have a treasury worth more than $2.4 Bn. Stay tuned! Singular DAO is coming!

3.) EV Booms and Raw Materials Shortage

Despite a mere 6% share of global vehicle sales in 2021, electric vehicles (EVs) punched above their weight in their demand for semiconductors, copper, and lithium. According to World Economic Forum Studies, the global light-duty vehicle (LDV) fleet in 2020 to 31% in 2050 reaching 672 million.

Compared to vehicles powered by internal combustion engines, EVs require two to three times as many semiconductors and roughly four times as much copper. They also account for roughly 74% of global lithium consumption.

Singular’s Take: Three Words - 1️⃣Lithium, 2️⃣Cobalt and 3️⃣Copper. Lithium prices have “gone to the moon” as surging more than 500% as EV sales worldwide soar.

Singular’s Action: : The three materials above is the New Oil! NVIDIA > 🧠 of EV, Lithium, Copper + Cobalt Long on Dips with 2-3 years horizon.