Crypto ETFs Surge, Digital Assets Outperforms TradFi, Exploring TradFi's Perfect Hedge

Biggest Global IT Outage causes $5B in Losses

By @0xHooi

Chief Investment Strategist

The below is the opinion of the authors. Any conclusions are their own. This should not be considered as investment advice. Investing involves the risk of loss and returns are not guaranteed.

1.) Ethereum ETFs Reach $1B on First-Day

Six months after the successful launch of spot Bitcoin ETFs, nine similar Ethereum ETFs from institutions like BlackRock, Fidelity, and VanEck debuted, with Coinbase as the custodian partner for eight of them. By the end of the first trading day, these ETH ETFs recorded over $1 billion in trade volume, representing 23% of the Bitcoin ETFs’ initial trading volume, and net inflows of $107 million, compared to Bitcoin’s $600 million. Despite a slight drop in ETH prices, these ETFs offer an accessible way for traditional financial entities to gain exposure to Ethereum’s price movements.

Spot ETH ETFs vs. Direct ETH Purchase:

• Exposure to Price Movements: Spot ETH ETFs offer exposure to ETH’s price without owning it directly; buyers own shares backed by ETH.

• Accessibility for Investors: Easier for retirement accounts, hedge funds, and pension funds to gain exposure through conventional exchanges.

• Advisor Convenience: Simplifies offering ETH to clients for financial advisors.

• Direct Purchase Benefits: Allows for uses like buying NFTs, engaging in DeFi, and staking for rewards.

• Analyst Predictions: Expected strong interest and significant inflows, with estimates ranging between $4.8 billion to $6.4 billion in the first year.

2.) Crypto Outperforms TradFi

From Q4 2023 to Q1 2024, BTC and ETH saw significant gains of 155.35% and 105.71%, respectively, driven by renewed interest from ETF narratives. This resurgence emphasized the strong appeal of these leading digital assets. Conversely, traditional financial markets experienced mixed performance, with downturns in September to November due to the Federal Reserve’s high interest rates impacting stock prices. Despite this, major indices like the S&P 500, Nasdaq-100®, and Dow Jones achieved returns of 16.56%, 17.76%, and 14.65%, respectively, demonstrating the broader equity market’s resilience amidst macroeconomic challenges.

3.) Crypto as a Perfect TradFI Hedge?

BTC and ETH exhibit high correlations with each other, acting as benchmarks for the crypto market, while showing low correlations (below 3%) with traditional indices, equities, or fixed income. Notably, BTC has negative correlations with major equity indices, suggesting it could serve as a diversification hedge for equity-focused portfolios.

Adding a modest allocation of 5% into BTC and ETH to a well-diversified equities portfolio, like the S&P 500, can significantly enhance risk-adjusted returns, boosting the Sharpe ratio from 2.20 to 3.15, a 43.6% increase. This diversification benefit is most effective with up to 15% crypto allocation. At a 50/50 split between equities and crypto, the Sharpe ratio reaches 5.85, nearly matching an all-crypto portfolio’s 7.61 but with significantly lower risk, evidenced by a standard deviation of 24.66% compared to 48.20%.

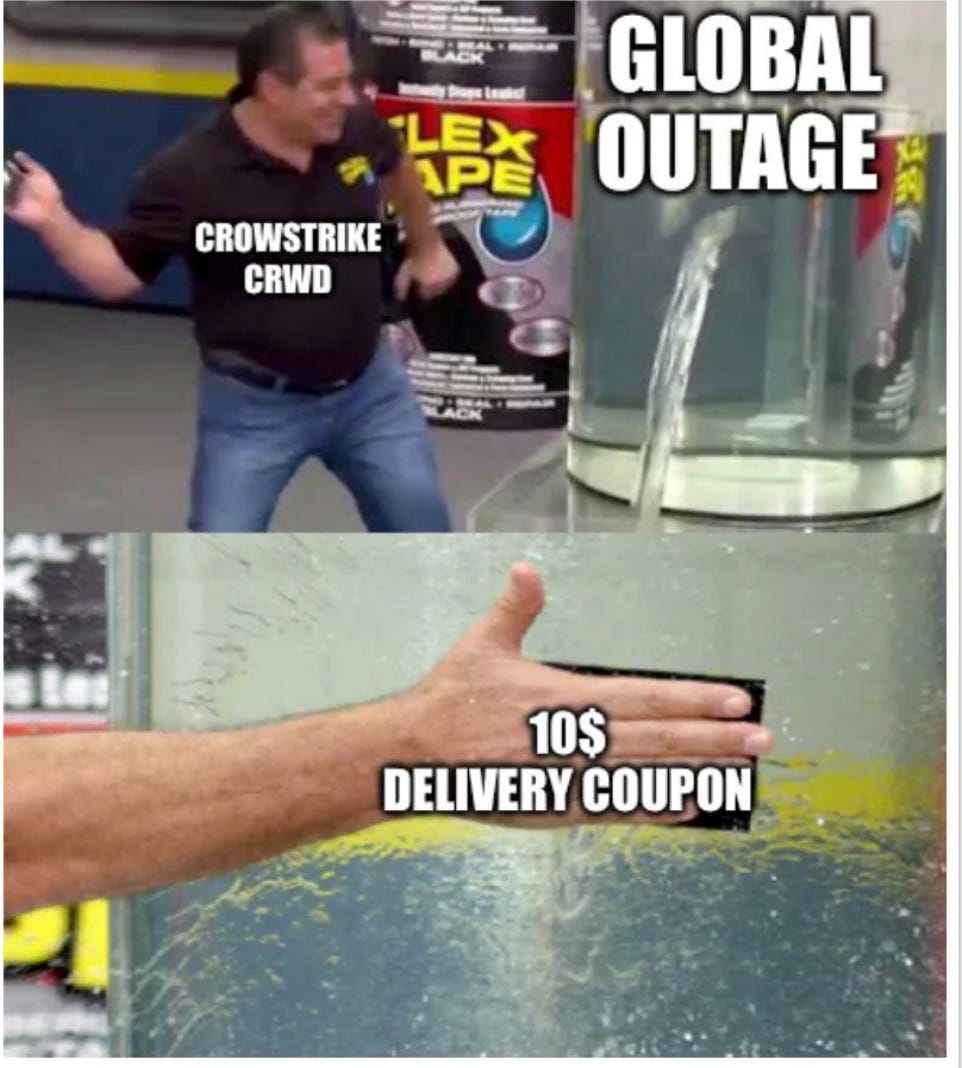

Meme of the Week

Important Disclaimers