Blackrock's BTC Holding, NVIDIA still Booming, Trump's Tariff Tsunami and US Bitcoin Reserve

1.) NVIDIA AI Gambit

Call it the underdog of the AI arms race, the wildcard of machine learning, or the latest headache for Silicon Valley—China’s DeepSeek is proving it can go toe-to-toe with the best AI labs in the world.

DeepSeek’s newest open-source model, R1, is shaking up the industry by offering high-performance AI for free, unlike OpenAI’s $200/month ChatGPT Pro. The Chinese firm has positioned itself as a formidable rival to Western AI giants, and early reports suggest it outperforms OpenAI’s models in reasoning and coding tasks. If validated, this could be a game-changer—especially for developers looking to ditch expensive, closed-source models.

Wall Street and Washington Are Paying Attention

The timing couldn’t be worse for Nvidia, which is caught in the crossfire. The chipmaker posted a record-breaking $39.3 billion in Q4 revenue, but its stock tumbled 17% after DeepSeek’s rise spooked investors. Now, with the U.S. weighing further chip export restrictions to China, Nvidia’s dominance is facing pressure from both regulators and new competition.

Looking ahead… while DeepSeek’s threat has quieted—for now—geopolitics may pose a bigger challenge for Nvidia than any AI startup ever could. If the U.S. tightens restrictions on AI chip sales, China’s next move might not just be building better AI models—it might be making its own Nvidia.

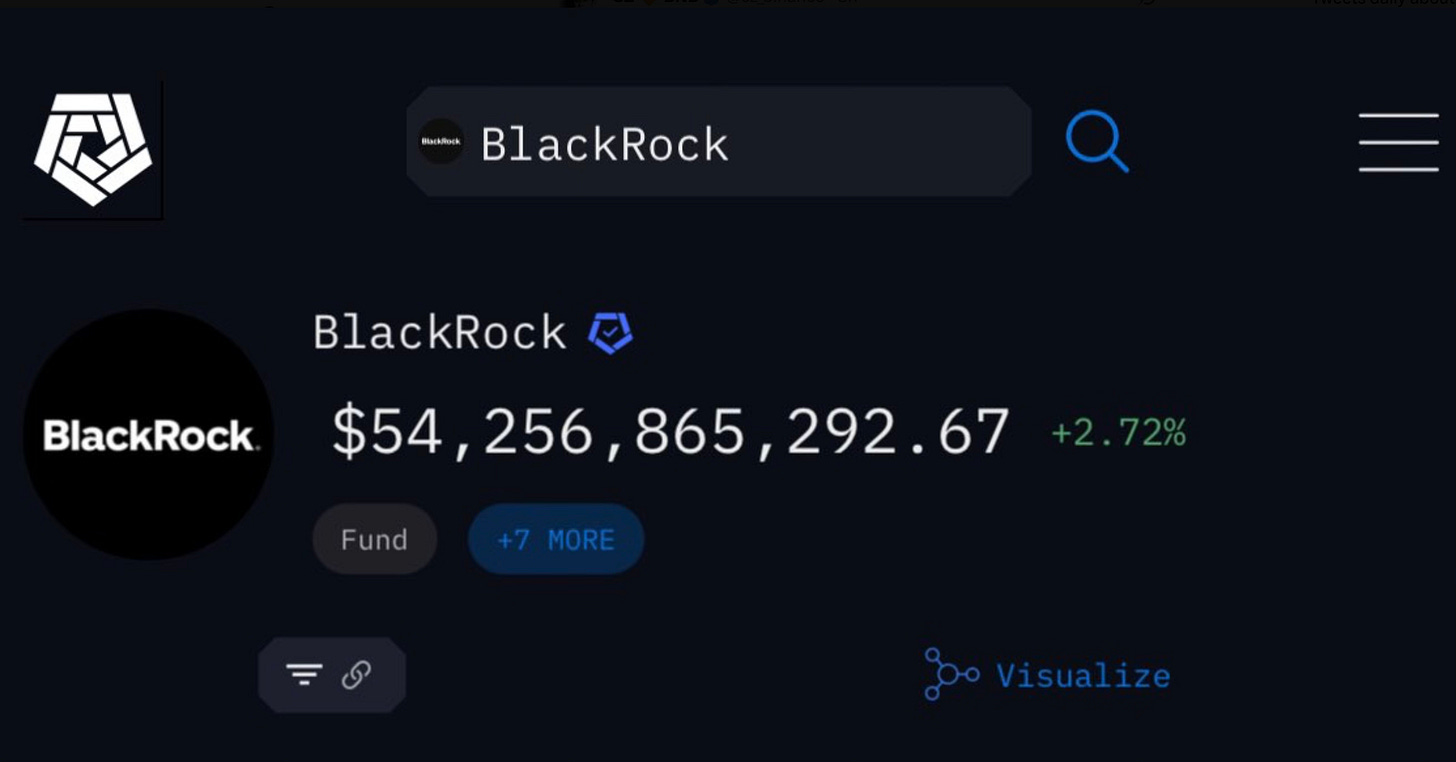

2.) BlackRock Goes All-In on Bitcoin

Wall Street’s biggest asset manager is making an even bigger bet on Bitcoin. BlackRock’s Bitcoin ETF holdings have officially crossed the $50 billion mark, cementing its position as one of the largest BTC whales in the world. The fund has been stacking Bitcoin at an unprecedented pace, signaling that institutional appetite for digital gold isn’t just growing—it’s surging.

And yet, markets still seem to be underestimating the impact. BlackRock, a firm managing $10 trillion in assets, isn’t just dipping its toes—it’s diving headfirst into Bitcoin. With steady inflows, regulatory green lights, and rising demand, it’s becoming harder to argue that crypto is a fringe asset. If the world’s biggest money manager is this bullish, maybe the rest of us aren’t bullish enough.

3.) Trump’s Tariff Tsunami: Trade War Heats Up

President Trump confirmed that new tariffs on Mexico, Canada, and China will take effect on March 4, escalating trade tensions and rattling markets.

What’s Happening?

• 🇲🇽🇨🇦 25% tariffs on Mexican & Canadian imports (10% for Canadian energy).

• 🇨🇳 Extra 10% tariff on Chinese goods, stacking on February’s 10% hike.

• March 12: 25% tariff on all steel & aluminum imports.

• April 2: Trump to unveil a reciprocal tariff plan, possibly targeting EU’s VAT system.

Why It Matters

• Markets & business leaders are uneasy—over $1 trillion in imports will be affected.

• Canada’s election is shifting, with Trump’s policies impacting voter sentiment.

• U.S. consumer confidence is dropping, signaling potential economic fallout.

China is hitting back in the escalating trade war, announcing new tariffs on U.S. goods in response to Trump’s 10% duty on all Chinese imports.

China is also tightening regulatory pressure on American firms, launching an antitrust probe into Google and adding PVH Group (parent company of Calvin Klein and Tommy Hilfiger) and biotech firm Illumina to its “unreliable entities” list. While China’s tariffs only

Brace for impact—this trade war is just getting started.

BREAKING! Trump Orders U.S. to Stockpile Bitcoin in Strategic Reserve

President Trump has signed an executive order creating a Strategic Bitcoin Reserve, marking a major shift in the U.S. government’s approach to digital assets. The reserve will be funded exclusively with bitcoin seized from criminal and civil forfeiture cases, avoiding any taxpayer burden. The order also mandates a full audit of government-held digital assets and prohibits the sale of bitcoin from the reserve, reinforcing its role as a long-term strategic asset.

Beyond bitcoin, the order establishes a U.S. Digital Asset Stockpile to manage other confiscated cryptocurrencies under the Treasury Department’s oversight. Trump’s crypto czar, David Sacks, confirmed that this policy aligns with efforts to make the U.S. a global leader in digital assets. While some in the industry remain skeptical, citing concerns over government control, the move signals a clear recognition of bitcoin’s strategic value on the global stage.

Important Disclaimers