All about "Transitory" Inflation, Yearn and 88x Growth in DeFi

Yearn Curve, Decentralized Finance, HonestYields Exclusive Field Report

Happy Wednesday Everyone 😃

We’ve heard a lot of shaky arguments against crypto. We’ve also received a lot of requests for Macro Markets.

Like the biggest threat to crypto…is crypto??

But we want to hear about the best one you’ve heard.

But first, here are SIX things to get started in 60 seconds ⏱

Could we see a 2018 repeat?

Carbon Credit up 109.4% This Year. What’s Behind the surge?

Decentralized Finance has grown by 88x in a year where does DeFi go from here?

NFT art is just the beginning in Web 3.

Under the Radar: Yearn Curve- Analysis Report by HonestYield

Could we see a 2018 repeat?

Yes, the Fed did raise interest rates in September 2018 and dropped an “accommodative’ language from its policy statements that caused the crash in 2018 and it the markets rebounded strongly to a new high shortly after.

However, Fed Chairman Jerome Powell’s new hawkish tilt during moratorium signaling an acceleration in tapering of asset purchases and discussing when to increase interest rates again.

We need to talk about what “transitory inflation” means because inflation is making everyone miserable. For starters, Merriam Webster defines it as “of brief duration.”

According to Bloomberg, inflation is transitory remains a key factor and in October, after months calling inflation transitory, it was still higher than any point in the past 31 years. As a result, we are still seeing record-high stock prices and decent job growth.

Key Takeaway: Fed expected to speed up the end of bond-buying and during these two days Dec 14-15th and it could also begin to raise interest rates faster. The inflation rate is currently at 6.8% YoY = We remain long on Stocks and Crypto.

What’s Behind Carbon Credits Surge to All Time Highs

The Carbon Emissions chart definitely looks something like a meme stock of crypto chart. So what caused prices of carbon credits in the European Union to rally to all-time high in 2021?

Gas shortages and reliance on carbon-intensive coal result and demand for carbon offsets. We’re up big on two carbon plays namely Carbon Streaming Corporation bought first entry posted in Oct 2021. Singular also expects policymakers to intervene Dec 14th -15th and reign in and contain the prices in carbon credits.

Decentralized Finance has grown by 88x in a year where does DeFi go from here?

With higher and higher interest rates and innovative money legos getting more open and permissionless, Decentralized Finance or Defi is just getting started.

What’s the difference between FinTech and DeFi. FinTech refers to traditional finance integrations with technology. For instance Paypal, Venmo, Square, Alipay etc.

Fintech was built on top of centralized markets and traditional finance.

DeFi over a year has seen lots of developers building Decentralized Applications of DaPPs what Fintech built in 10 years in a single hackathon.

Read More here on our previous post :

In June last year, TVL sat at about $1 billion worth of cryptocurrency deposited in DeFi applications. Today, the TVL figure exceeds the $60 billion mark, and it peaked at over $86 billion in mid-May. Source: DeFi Pulse

NFT art is just the beginning in Web 3.

Okay, you probably heard of lot about NFTs over the past few months and you might be thinking, we would pay thousands for some JPEGs? Turns out NFT sales volume has surged to $27Bn. from just $2.5 Bn. in first half of 2021.

According to OpenSea buyers averaging 10,000 to 20,000 per week since March has outnumbered sellers.

Source: OpenSea, CryptoArt

Sports and Collectibles remain the most popular. Marketplaces like The U.S National Basketball Association Top Shot allows fans to buy and sell NFTs in the form of video highlights.

Source: Non-Fungible

Other notable NFT community like The Bored Ape Yacht Club, has a set of 10,000 unique digital ape NFTs sold on OpenSea for $3,600 is up 1,573% where total sales jumped to $61 million according to The Bored Ape Yacht Club’s creators.

This Week in DeFi: Yearn Curve 3Pool Vault Field Report by HonestYields

HonestYields is an aggregation-layer and UI/UX-layer that helps investors to make better decisions and more easily invest in DeFi

Total assets locked up: 20,990,690.76000 USD

Underlying Asset: Curve 3pool token (3Crv);

Number of strategies : 2

Types of Defi strategy utilize : Liquidity provision, staking

Strategy allocation :

StrategyConvex3Crypto: 100%

Curvecrv3cryptoVoterProxy: 0%

Management Fee :2%

Performance Fee: 10%

Developer : Yearn.Finance

Smart contract: 0x84E13785B5a27879921D6F685f041421C7F482dA

Protocol dependencies : Curve

Convex

Yearn Curve 3pool vault is a vault that aims to generate yield on the curve 3Crv token. The primary way it does this is through staking. However, the underlying token is an LP for curve’s 3pool liquidity pool and hence, this vault is inherently exposed to liquidity provision as a strategy as well.

Underlying Token

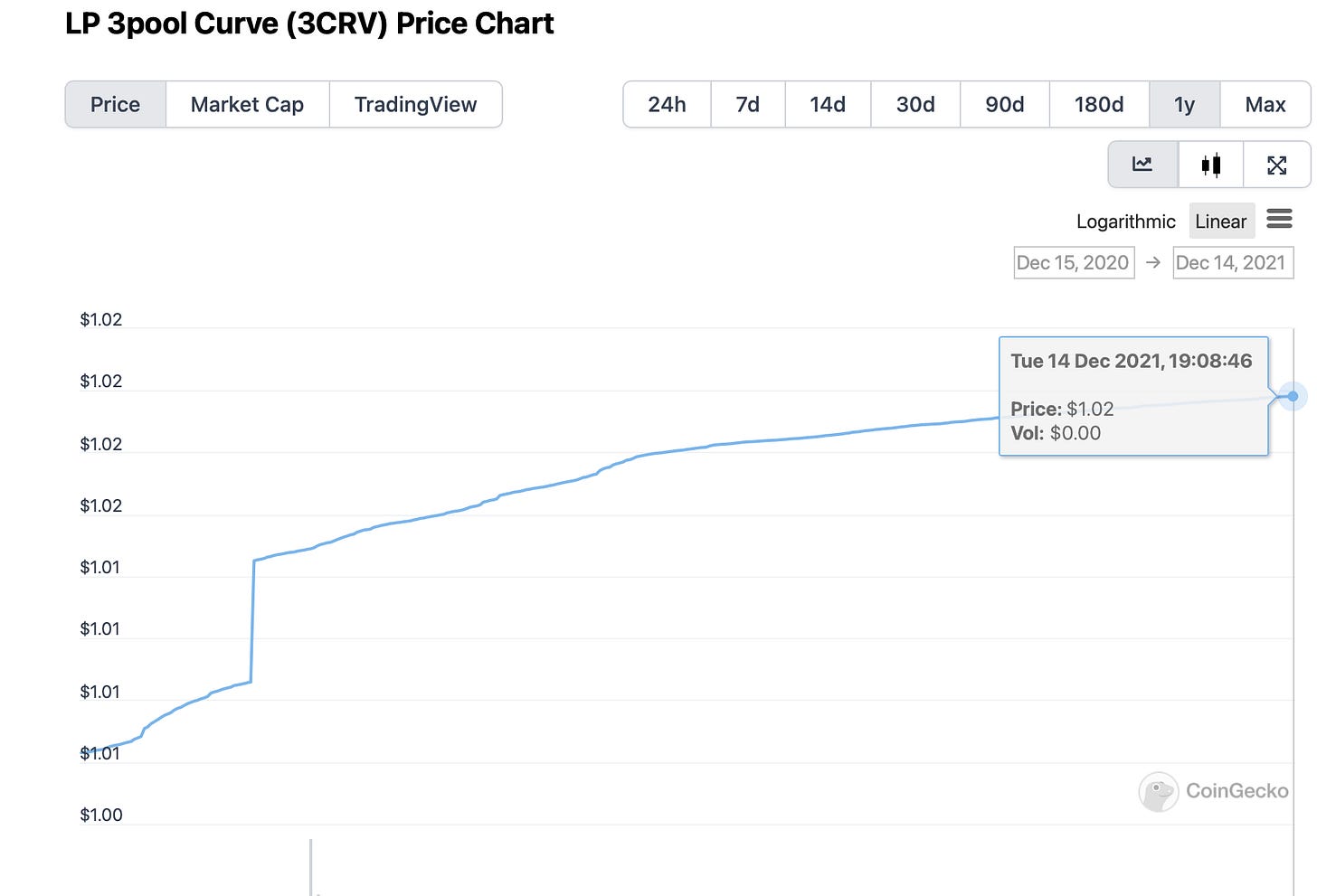

The underlying curve 3Crv token is an interest bearing stable coin which represents a claim on Curve’s 3pool liquidity pool. The profits from the pool is accrued over time and this transfers to the value of the LP token. Hence, unlike other stable coins the 3pool token value tends to increase over time. The underlying liquidity pool consist of DAI, USDT and USDC. 3pool tokens can be redeemed for any of the underlying. As a result depegging of any of this coins would cause the value of 3Crv to fall. 3CRV tokens can be obtained by depositing any of the above stable coins into the 3pool liquidity pool or as a reward for staking CRV tokens on Curve. Secondary market liquidity for 3CRV is poor with virtually 0 volume on Uniswap. As the underlying 3pool is a liquidity pool that facilitates automated market making, it is subjected to impermanent loss. While the risk of impermanent loss is low for stablecoins, depegging of stablecoin might lead to material losses.

Price History of 3CRV, steady increase in value over time

👉 Download Yearn Curve Report

Closing Thoughts

DeFi growth in the ethereum network has exploded in dollar terms over the past year and the Singular team remains bullish in this space as more Dapps or Decentralized Applications allow lending and borrowing of digital assets, derivatives, insurance and even the management of crypto assets, similar to a robo-advisor begin to emerge in the DeFi world.

Until next time,