1.) Election 2024 Recap: Trump Wins, GOP Secures Senate Majority

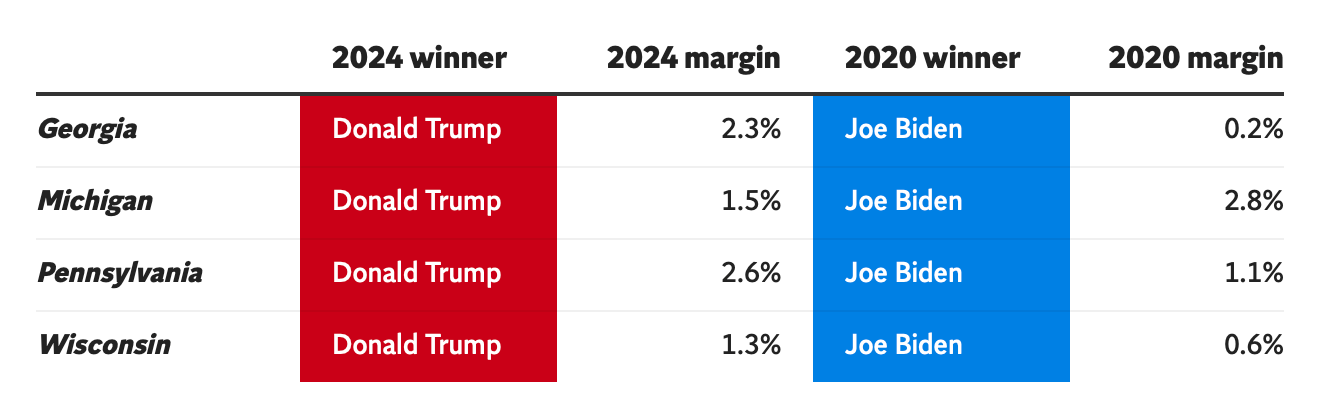

On Wednesday, Kamala Harris conceded to Donald Trump, who secured at least 295 electoral votes, reclaiming the presidency with a significant lead. The final tally may shift as Arizona and Nevada are yet to be called, but Trump has surpassed the 270-vote threshold required to win. Voter turnout was robust, with an estimated 64.5% of eligible voters participating, close to the record high in 2020. States like Georgia, Michigan, Pennsylvania, and Wisconsin flipped from Biden to Trump, reaffirming his swing-state appeal.

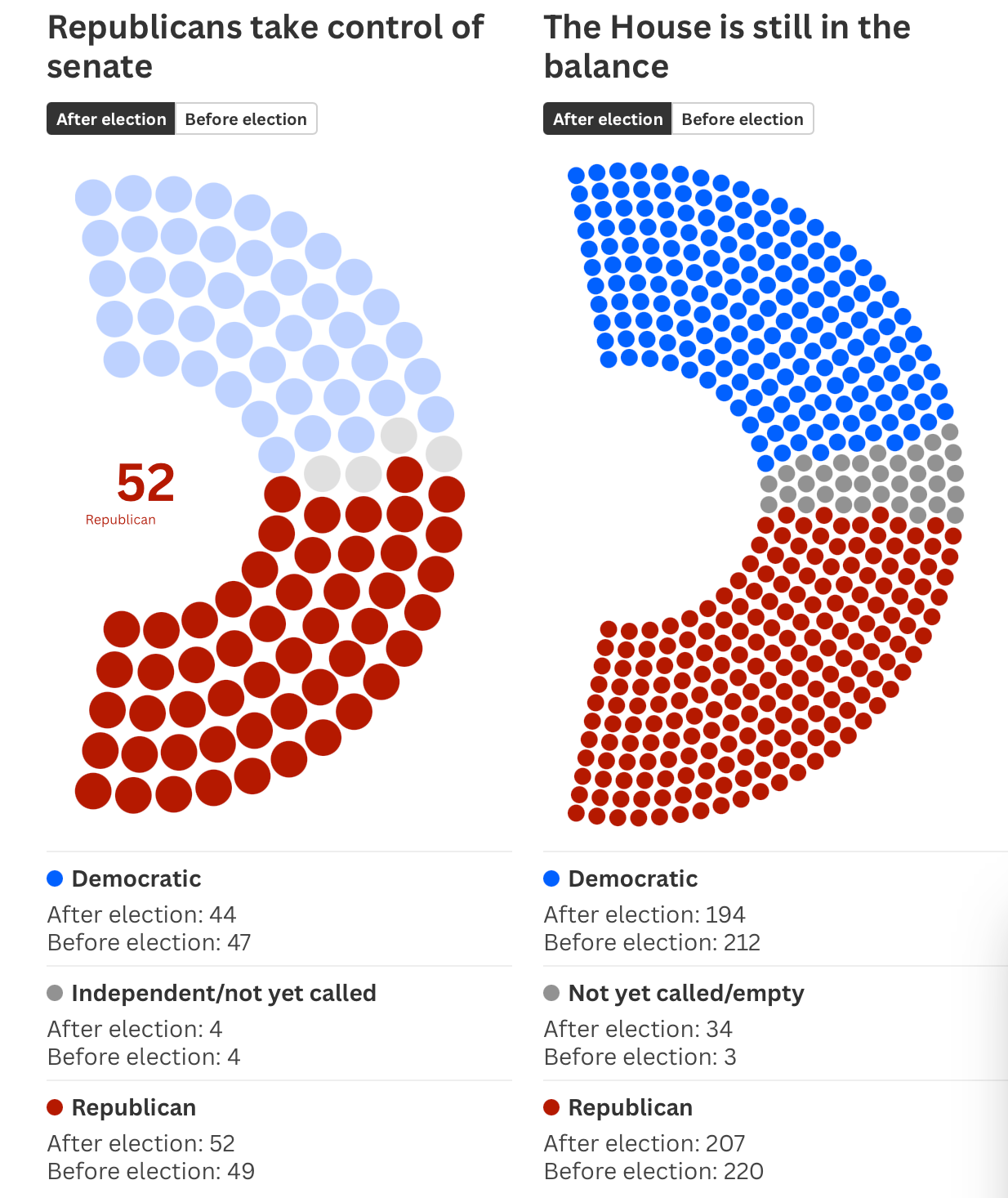

In Congress, Republicans have gained control of the Senate, holding 52 seats, with three races yet to be decided. The House remains tightly contested, with Republicans currently holding 211 seats to the Democrats’ 203. If the GOP retains a majority in both chambers, Trump will preside over a unified government, potentially creating a “triple threat” scenario with control over the executive, legislative, and a conservative-leaning Supreme Court. Early exit polls show voter demographics trending toward Trump among Black and Latino men, underscoring shifts that may impact future elections.

2.) Alphabet’s Strong Earnings

Alphabet reported a strong Q3 2024, with revenues up 15% year-over-year, totaling $88.3 billion. Google Services grew by 13%, largely from Search, YouTube, and subscription services, while Google Cloud surged 35% to $11.4 billion, driven by advancements in AI infrastructure and generative AI products. Operating income rose 34%, expanding the margin to 32%, and net income increased to $26.3 billion, with EPS reaching $2.12.

CEO Sundar Pichai highlighted Alphabet’s sustained momentum across platforms, underscoring the impact of new AI features in Search, which are reshaping user interactions, and the adoption of AI-driven solutions in Google Cloud, attracting larger deals. YouTube also reached a new milestone, with ads and subscriptions bringing in over $50 billion in the past year.

3.) US Economy Grows 2.8%

The U.S. economy expanded at a robust 2.8% annual rate in Q3, driven by strong consumer spending despite high interest rates, according to the Commerce Department. Consumer activity, which fuels 70% of the economy, surged to a 3.7% pace, and exports grew by 8.9%. Business investment, however, saw mixed results, with a sharp drop in housing investments but increased spending on equipment.

Encouragingly, inflation cooled further, with the Fed’s preferred gauge, the personal consumption expenditures index, rising just 1.5% over the quarter, the lowest rate in four years. Looking ahead, the Fed is expected to implement another rate cut next week, likely by 0.25%, with further reductions anticipated through 2025 and 2026. This gradual easing could lead to lower borrowing costs for consumers and businesses, reshaping the economic landscape.

Important Disclaimers